Is the US running out of Social Security?

Summary

TLDRSocial Security, officially known as the Old-Age, Survivors, and Disability Insurance Program, is a crucial support system for retirees, families, and the disabled in the U.S. However, it faces a long-term financing shortfall due to the aging population and the baby boomer generation. The program, which has kept millions above the poverty line, now operates in a deficit, relying on a $2.9 trillion surplus expected to run out by 2033. Possible restructuring options include taxing high earners' investment income, raising or removing the payroll tax cap, increasing the payroll tax, reducing benefits, or raising the full retirement age. The future of Social Security benefits will depend on how Congress addresses this challenge.

Takeaways

- 💰 Social Security is crucial for millions of Americans, being the primary source of income for most retirees and a significant factor in keeping older Americans above the poverty line.

- 👥 The program, officially known as 'The Old-Age, Survivors, and Disability Insurance Program,' also provides support for families when a working-age parent or spouse dies or if a worker becomes disabled.

- 💼 Almost all U.S. workers contribute to Social Security through a payroll tax, with both employees and employers paying 6.2% of wages up to a certain cap.

- 📈 Social Security faces a long-term financing shortfall due to the aging population, particularly the baby boomer generation, leading to a shift from a surplus to a deficit as more people retire and collect benefits.

- 💹 A $2.9 trillion reserve has been built up from past surpluses, but this reserve is projected to be depleted by 2033, necessitating reform to sustain the program.

- 🚨 Despite the looming shortfall, Social Security will not run out of money entirely; however, the nature of the benefits may change depending on Congressional action.

- 📊 Potential restructuring options include taxing high investment income, removing or raising the payroll tax cap, increasing the payroll tax, reducing benefits, or raising the full retirement age.

- 🌐 Raising the full retirement age results in lower benefits over a lifetime, and while it's a contentious issue, it may be considered as part of the solution.

- 🤝 Social Security embodies a generational compact, with all Americans contributing to and benefiting from the system in the face of retirement, death, or disability.

- 📝 Congress is likely to make decisions on restructuring Social Security at the last minute, as benefit cuts and tax increases are unpopular but may be necessary to ensure the program's future.

- 🔄 The future of Social Security will depend on a combination of the chosen reforms, which will balance increased contributions and adjusted benefits to maintain its vital role in American society.

Q & A

What is the primary concern regarding Social Security?

-The primary concern is that Social Security is facing a long-term financing shortfall due to the aging population and the retirement of the baby boomer generation, which means there will be fewer workers contributing to the program and more beneficiaries collecting benefits.

What does the term 'Social Security' actually refer to?

-The term 'Social Security' refers to 'The Old-Age, Survivors, and Disability Insurance Program,' which is a federal program that provides financial support to retirees, surviving spouses and children, and people with disabilities.

How does Social Security function as a system?

-Social Security functions as a pay-as-you-go system where current workers contribute to the program via payroll taxes, and those funds are used to pay out benefits to current retirees and beneficiaries. The amount of the benefit is determined by the average of the worker's earnings throughout their career and the age at which they start collecting benefits.

What is the significance of the Social Security tax cap?

-The Social Security tax cap is the maximum amount of income that is subject to the payroll tax. In 2022, the cap is $168,600, meaning that only a portion of income up to this cap is taxed for Social Security purposes. Individuals who earn more than the cap pay the same amount of Social Security tax, regardless of their actual income level.

How has the aging population affected Social Security?

-The aging population, particularly the baby boomer generation, has led to a situation where more people are collecting benefits than are paying into the system. This demographic shift has resulted in Social Security transitioning from a surplus to a deficit, with fewer workers supporting each beneficiary.

What happened in 2021 that impacted Social Security?

-In 2021, Social Security stopped operating in a surplus and fell into a deficit for the first time, as more people began to collect benefits and there were not enough workers to sustain the previous balance between contributors and beneficiaries.

What is the current status of the Social Security trust funds?

-The Social Security trust funds, which are managed by the federal government, are currently being used to pay out benefits to retirees and other beneficiaries. About 80% of each benefit comes from these trust funds, while 20% is drawn from a surplus that is predicted to run out by 2033.

What are some potential solutions to address the Social Security shortfall?

-Potential solutions include taxing high investment income, removing or raising the payroll tax cap, increasing the payroll tax, reducing the amount of benefits each person can receive, and raising the full retirement age. Each of these options has different implications and levels of public support.

What is the role of Congress in the future of Social Security?

-Congress has the responsibility to restructure the Social Security program to address the baby boomer conundrum and ensure the program's solvency. This may involve making difficult decisions regarding tax increases, benefit cuts, or other structural changes.

How does the concept of 'intergenerational compact' relate to Social Security?

-The concept of 'intergenerational compact' refers to the idea that Social Security is a shared responsibility and benefit among all generations. Current workers contribute to support retirees, and in turn, future generations will contribute to support the current workers when they retire, creating a cycle of mutual support across generations.

What is the expected timeline for the depletion of the Social Security surplus?

-The Social Security surplus, which is currently used to supplement the shortfall in the trust funds, is projected to be depleted by 2033. After this point, Congress will need to take action to ensure the continued支付 of benefits.

Outlines

💼 The State of Social Security

This paragraph discusses the current challenges facing Social Security, highlighting its importance as the primary source of income for most retirees and its role in supporting families in cases of death or disability. It explains the structure of the program, including the payroll tax that funds it, the existence of a cap on taxable earnings, and the division of collected funds into trust funds. The segment also addresses the long-term financing issues due to the aging population, particularly the baby boomer generation, and the resulting shift from surplus to deficit. It clarifies that while the $2.9 trillion surplus is predicted to run out by 2033, Social Security benefits will continue, but their form may change depending on Congressional actions to address the demographic challenges.

📱 Metro by T-Mobile's Role and Social Security Restructuring Options

The paragraph begins with a brief mention of Metro by T-Mobile's sponsorship and their aim to help customers avoid wasting tax refunds. It then transitions back to discussing Social Security, presenting five potential options for restructuring the program to address its financial challenges. These include taxing high investment income, removing or changing the salary cap, raising the payroll tax, cutting benefits, and raising the full retirement age. The paragraph acknowledges the unpopularity of these options but emphasizes the widespread value of Social Security across different demographics. It concludes by reflecting on the communal aspect of Social Security as a generational compact for mutual care during retirement, death, or disability.

Mindmap

Keywords

💡Social Security

💡Payroll tax

💡Trust funds

💡Aging population

💡Baby boomer conundrum

💡Financing shortfall

💡Full retirement age

💡Tax cap

💡Deficit

💡Congressional action

💡Generational compact

Highlights

Social Security is facing a financial crisis due to the aging population and the baby boomer generation.

Social Security is crucial for retirees, keeping nearly 16.5 million older Americans above the poverty line in 2022.

Social Security supports families in cases of death or disability of a working-age parent or spouse.

Every U.S. worker contributes to Social Security through a payroll tax, with both employees and employers paying 6.2% of wages.

There is a cap on the Social Security tax for individuals earning above a certain amount, currently $168,600.

Social Security funds are divided into two trust funds managed by the federal government and used to pay current beneficiaries.

Retirees can start collecting Social Security benefits at age 62, but the maximum benefit is reached by waiting until age 70.

Social Security stopped operating in a surplus in 2021 and fell into a deficit due to more people collecting benefits.

The $2.9 trillion surplus is predicted to run out by 2033, leading to uncertainty about the future of the program.

Congress may need to restructure the Social Security program to address the challenges posed by the baby boomer generation.

Raising the payroll tax or changing the salary cap could help offset the imbalance between beneficiaries and workers.

Cutting the amount each person can receive or raising the full retirement age are unpopular options to balance Social Security finances.

Social Security benefits will continue to be paid in some form, even after the surplus runs out.

Social Security represents a compact between generations to support each other in retirement, death, or disability.

The current situation with Social Security highlights the importance of understanding the program and its future.

The options for restructuring Social Security are not appealing for today's workers, involving either paying more or receiving less.

Transcripts

Social Security’s in trouble.

The program is quickly running out of cash.

Millennials and younger don't believe that

they're going to see a penny of Social Security.

As a millennial, this has been my introduction

to Social Security.

It's like the government pulls some money from my paycheck

and then it goes into some imaginary fund

that maybe I'll never see again.

The truth is, I know embarrassingly little about this program

that most Americans rely on for retirement.

Before you go and dive into the comments, it seems

nobody gets it.

This poll looked at people near the retirement age

who are about to start collecting it.

But rather than succumb to the void like I want to,

I read entirely too much about it so you don't have to.

So what is Social Security and is it actually doomed?

It's really hard to

overstate how important Social Security is.

The official name of Social Security is “The

Old-Age, Survivors, and Disability Insurance Program.”

It can kind of be broken down into three parts.

Most people are familiar with the old-age one.

That's retirement.

It's the biggest source of income for most retirees.

See the chart?

Actually. Here's an updated one.

In 2022,

this program alone was responsible for keeping nearly 16

and a half million older Americans above the poverty line.

But it's also so important for families.

It supports people when a parent or a spouse dies,

you know, when they're still of

working age, it supports people if they become disabled

and are not able to continue

working and supporting their families.

Thus, the name.

Every U.S.

worker pays into social Security via a payroll tax.

Well over 90% of American workers

just pay 6.2% of their wages

out of every paycheck into Social Security,

and then their employers pay another 6.2%.

There is a cap on this tax,

though, as in if you make more than a certain amount of money,

the government's only going to tax a portion of it

for Social Security.

The cap this year is $168,600.

Still with me?

Or you sinking into the void of financial lingo?

Come back.

We're almost there.

Now, you can literally look at your pay stub

and see where the Social Security tax comes out.

This money goes into two trust funds

managed by the federal government

and is then used to pay out the people

who are currently collecting

typically in the form of monthly checks.

When you retire

the size of that check is determined by the average

of how much you've made throughout your working life ...

and the age you start to collect.

As of now, retirees can start collecting at age 62,

but they won't max out the benefit unless they wait

until they're 70.

So to recap, current workers pour money into trust funds,

and those trust funds are used to pay out

current beneficiaries.

As long as people are working.

This tax is being paid

and there will always be money in those funds.

So why does everybody keep saying it's being drained?

So the reason that Social Security

faces a long term financing shortfall

is the aging of the population.

In other words, boomers.

Here's a chart of the US population.

As you can see, there's a bump here.

That's the baby boomer generation.

For decades, this giant population

was the main workforce that paid into Social Security.

That means more people

were putting money in than taking money out.

So those trust funds that we talked about earlier

had a surplus,

and the US Treasury took that extra money and invested it.

And those investments ultimately

gave us a $2.9 trillion dollar reserve.

Then came 2021.

At this point, Social Security stopped operating in a surplus

and actually fell into a deficit

because more and more people started to collect.

We just don't have quite as many workers

supporting each beneficiary as we used to.

But it's fine right now

because 2.9 trillion is a nice pile of money

that's been supplementing the shortfall.

So every Social Security check

a beneficiary gets right now

is kind of made up of two things.

About 80% of that is the trust funds

that are being filled by everyone still working.

And about 20% is coming from that $2.9 trillion surplus.

And that surplus is what's predicted to run out by 2033.

And then after that point, about ten years from now,

there is some uncertainty about what will happen.

What won't happen is a total draining of Social Security.

There will always be benefits in some form.

It may look different

from the Social Security benefits that are paid now,

but there's really no question of whether Social Security

benefits will be paid for into the future.

What those benefits

look like entirely depends on

how Congress decides to restructure the program

to get over this baby boomer conundrum.

This episode is presented by Metro by T-Mobile.

This tax season.

Metro wants to help customers avoid wasting dollars

by using their tax refunds

to catch up on things that they want,

not on things they don't.

According to Metro, you don't take yada yada in life,

so don't take yada yada from a wireless provider.

Metro by T-Mobile has no contracts, no credit checks,

and no surprises.

Metro does not influence the editorial process of our videos,

but they do help make videos like this possible.

To learn more, you can stop by one of over

6000 metro stores nationwide now.

Back to the video.

So there are a few options for restructuring the program.

Let's talk about the top five in a very bland

and unbiased way.

Starting with the high earners.

A lot of very wealthy people,

they don't get their money through salaries

like I make more in a salary

than Jeff Bezos does, for example.

And so he pays less in Social Security than I do.

Thanks, Jeff.

At least one bill is fighting

to add a Social Security tax to high investment income,

which is where a lot of rich people make and keep their money.

Then there's this.

We could remove or change that $168,000 salary cap.

The most popular option is to change the payroll tax cap,

either to get rid of it altogether

or to raise it so that it covers

more of high wage people's earnings.

These next two send people into a rage,

but they are kind of the most obvious.

Raising the payroll tax would immediately

start pumping more money into Social Security

and help offset the imbalance of beneficiaries and workers.

And cutting the amount

each person can actually receive

would balance the scales, even further.

But this is wildly unpopular across

party lines and with the public.

Granted, if Congress were to do nothing in

2033, benefits would automatically decrease.

And this option.

You've probably heard this before.

It did not go over well in France.

Raising the full retirement

age is a benefit cut.

Full stop. For everybody.

It means 7% lower benefits over a lifetime on average

for each year that you raise the retirement age.

It's hard to predict exactly what Congress will do,

but it's very likely they'll wait until the 11th hour to do it.

Because nobody really likes passing a benefit

cut or a tax increase.

For today's workers, the options are not a lot of fun.

I mean, it's either you pay more

or you get less or some combination thereof,

no matter what choice or combination of choices is made.

There will be losers.

Of all the things we can't agree on in the US, it's clear

that across party lines and all

ages, people value Social Security.

One of the beauties of the Social Security program is it

sort of like we're all in this together, you know?

We're all funding these benefits,

we're all benefiting from them, and it's kind of a compact

between generations to take care of each other.

When we face retirement, death or disability.

5.0 / 5 (0 votes)

Do VA Benefits Pass On to Family Members? | theSITREP

Why Does Gen Z Look SO Old? | Style Theory

Exposing the NSA’s Mass Surveillance of Americans | CYBERWAR

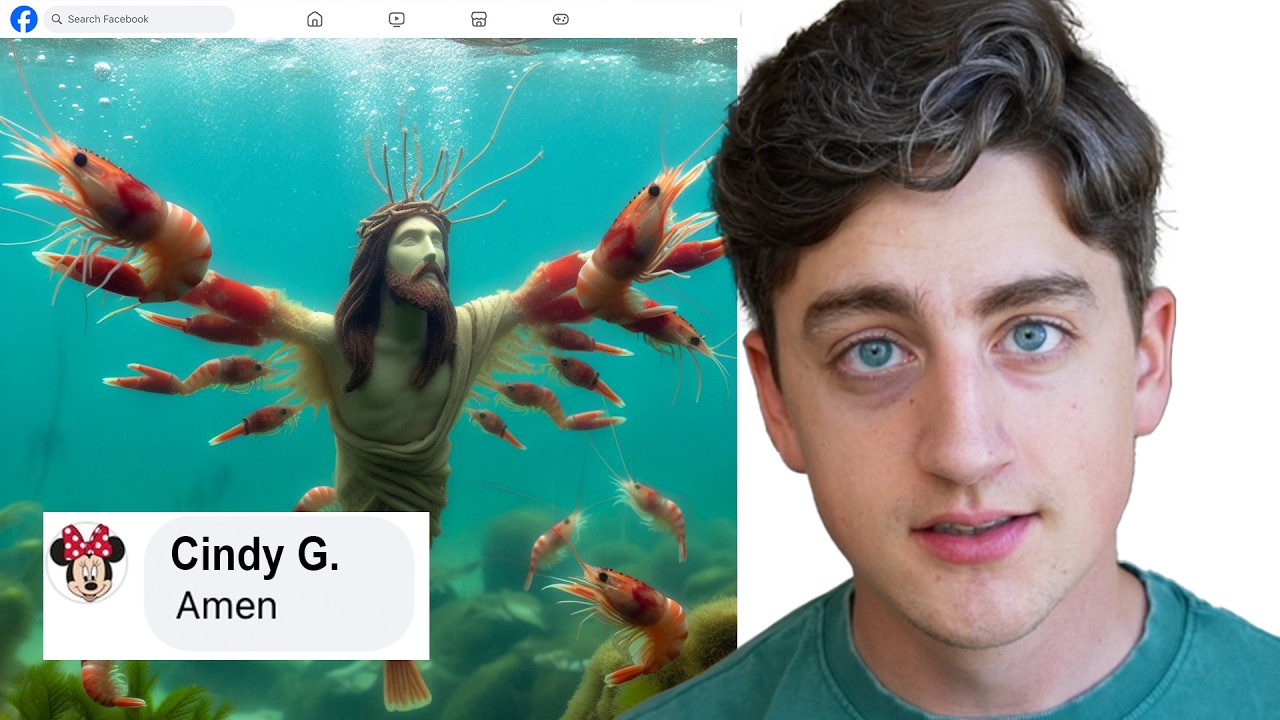

Boomers Getting Tricked By AI On Facebook

BOMBSHELL: House Republicans get the news they’ve been dreading

Bill Maher DESTROYS the Media | Real Time with Bill Maher (HBO)