Robinhood Investing For Beginners In 2024 | FULL Tutorial

Summary

TLDR本视频是一份全面的Robin Hood投资平台新手教程,从创建新账户到研究股票、投资S&P 500、探索加密货币选项,再到了解期权交易和其他功能,如现金管理等。视频还介绍了如何链接银行账户、存入资金、购买ETF,并提及了Robin Hood提供的退休账户选项和额外奖励。此外,还讨论了如何通过Robin Hood应用进行股票和加密货币的交易,以及如何利用其现金卡和其他金融工具来管理个人财务。

Takeaways

- 🌟 开始使用Robinhood投资平台,首先需要通过提供的链接或在应用商店下载应用并注册账户。

- 🔗 链接银行账户是投资前的重要步骤,可以通过应用内的指引轻松完成。

- 📈 研究股票信息时,Robinhood提供了丰富的数据和图表,帮助投资者做出明智的决策。

- 💰 投资者可以通过Robinhood投资股票、ETFs、加密货币等多种资产。

- 🌐 探索Robinhood的加密货币功能,了解如何购买、发送和接收加密资产。

- 💼 了解Robinhood提供的退休账户选项,如Roth IRA,并注意平台提供的额外贡献匹配。

- 🎯 投资S&P 500 ETF是一种分散风险的方式,适合长期投资策略。

- 📊 查看和分析股票和ETF的详细信息,包括市值、PE比率、分红收益率等。

- 🔄 学习如何在Robinhood中执行买卖操作,包括即时和定期投资。

- 💡 了解Robinhood Gold订阅计划提供的额外功能,如专业研究报告和更高的贡献匹配。

- 🛒 探索Robinhood Cash卡和其他赚取额外收益的方式,如投资零钱和购物返现。

Q & A

如何开设一个新的Robin Hood账户?

-首先,需要在Robin Hood的官网或应用上创建一个登录账号,填写个人信息如姓名、邮箱和密码。然后下载并安装Robin Hood应用,根据指引填写地址、社会保障号码等信息。完成这些步骤后,账户即可开通。

Robin Hood账户开通后如何获得免费股票?

-通过使用邀请链接(如ryan.com/start)注册Robin Hood账户,新用户在完成账户开通流程后,将有机会获得价值在5至200美元之间的免费股票。

如何在Robin Hood应用中链接银行账户?

-在Robin Hood应用中,点击右下角的个人菜单,选择“转账”选项,然后选择“链接账户”,可以选择通过借记卡进行即时转账或使用Plaid服务链接传统银行账户。

Robin Hood支持哪些投资选项?

-Robin Hood支持股票、ETFs、加密货币和期权交易。此外,还提供现金管理服务,允许用户在未投资的现金上获得高收益。

如何在Robin Hood上研究股票?

-在应用中搜索股票代码或公司名称,进入股票详情页面,可以查看公司信息、价格走势、交易量、市值、市盈率等数据。还可以阅读相关新闻和分析师评级。

Robin Hood如何进行ETF投资?

-在应用中搜索想要投资的ETF,例如Vanguard S&P 500 ETF,然后选择购买。Robin Hood支持使用美元进行投资,用户可以购买部分ETF份额,而不需要购买整股。

Robin Hood如何处理卖出股票后的收益?

-卖出股票后的收益可以保留在Robin Hood账户中,用于进一步投资。如果想要将资金提取到银行账户,需要等待至少30天。

Robin Hood的退休账户选项有哪些?

-Robin Hood提供Roth IRA退休账户,并为Robin Hood Gold会员提供额外的3%贡献匹配。所有用户至少可以获得1%的贡献匹配。

Robin Hood的现金管理服务有哪些特点?

-Robin Hood提供现金扫荡服务,将未投资的现金转入高收益储蓄账户,目前年化收益率为5%,远高于普通储蓄账户。

如何在Robin Hood上进行加密货币交易?

-Robin Hood允许用户通过应用进行加密货币的买卖。用户需要通过搜索特定加密货币并遵循应用内的指引完成交易。注意,加密货币交易是独立于Robin Hood主体的法律实体。

Robin Hood的期权交易有哪些特点?

-Robin Hood提供期权交易,没有佣金费用和月费。但是期权交易风险较高,不适合没有经验的投资者。

Outlines

🚀 开始Robin Hood投资之旅

本段落介绍了如何开启Robin Hood投资账户的全过程,从注册登录、下载应用、填写个人信息,到了解如何研究股票、投资S&P 500指数基金、探索加密货币选项等。强调了使用Robin Hood投资的便捷性和免费股票奖励,以及如何通过链接赚取更多收益。

🔗 链接银行账户与资金流转

详细说明了如何在Robin Hood应用中链接银行账户,并通过不同的选项进行资金的存取。介绍了如何使用借记卡即时转账,以及如何通过Plaid连接银行账户。同时,还探讨了如何研究股票,例如NVIDIA,并解释了市场表现、价格波动和公司基本信息。

📈 股票与市场分析

本段内容聚焦于如何分析股票市场,特别是如何使用Robin Hood应用来研究不同公司的股票和市场表现。通过NVIDIA和Johnson & Johnson的例子,解释了市盈率、股息率等关键财务指标,并讨论了不同行业的股票估值标准。

💹 加密货币与退休账户

介绍了Robin Hood应用中的加密货币投资选项,包括如何搜索和查看不同的加密货币。同时,还讨论了Robin Hood提供的退休账户选项,如Roth IRA,并提到了Robin Hood Gold订阅计划提供的额外匹配贡献。

🛒 投资S&P 500指数基金

本段落展示了如何通过Robin Hood应用投资Vanguard S&P 500 ETF,包括如何搜索ETF、理解其组成和历史回报率,以及如何利用小额资金进行投资。强调了分散投资的重要性,并提到了如何设置定期投资计划。

📖 投资资源与额外信息

最后一段提供了额外的资源和信息,包括如何获取免费的Robin Hood股票奖励,以及作者推荐的关于如何开始副业并最终实现财务自由的书籍。同时,还提供了作者的3小时股票市场入门课程链接,供有兴趣深入了解的观众参考。

Mindmap

Keywords

💡Robin Hood

💡投资账户

💡ETF

💡银行账户链接

💡股票研究

💡加密货币

💡退休账户

💡现金管理

💡期权交易

💡免费股票

💡投资策略

Highlights

这是一份全面的Robin Hood投资初学者教程,涵盖了从开设新账户到研究股票、投资S&P 500、加密货币选择以及期权交易等多个方面。

教程推荐使用提供的链接注册Robin Hood账户,以便获得免费股票奖励。

介绍了如何从零开始开设Robin Hood账户,包括填写个人信息、下载应用、以及完成必要的安全验证。

详细说明了如何将银行账户与Robin Hood连接,以便进行资金的存取。

强调了研究股票的重要性,并展示了如何在Robin Hood应用中查看股票信息和进行分析。

讨论了投资S&P 500的策略,推荐使用Vanguard ETF进行投资,并解释了这样做的多元化优势。

提到了Robin Hood提供的加密货币投资选项,并解释了如何通过应用进行加密货币的交易。

简要介绍了期权交易的概念,并指出这是高风险的投资领域。

说明了如何从Robin Hood账户中提取资金,包括卖出股票后的资金提取流程。

介绍了Robin Hood的现金管理功能,包括高收益储蓄账户和现金管理卡。

强调了Robin Hood不收取交易佣金的优势,并提到了其他小额费用的支付。

提供了关于如何利用Robin Hood进行长期投资和退休账户设置的信息。

分享了使用Robin Hood进行投资的个人经验和建议,包括投资策略和风险管理。

推荐了其他资源,如书籍和课程,供想要深入了解股市和投资的观众参考。

Transcripts

this is going to be the most thorough

and current Robin Hood beginner tutorial

out there so I'd recommend sticking

around for the entire video but if there

is a specific section that you're

looking for there is going to be a table

of contents down below where you can

skip around at any point in time we're

going to be covering opening a brand new

Robin Hood account from scratch we're

going to be getting a free stock I'm

also going to be showing you how to link

your bank account how to deposit money

into Robin Hood we're going to look at

how to research stocks on Robin Hood how

to invest in the S&P 500 using the

Vanguard ETFs we're also going to look

at some Robin Hood crypto options if you

want to invest in Bitcoin for example

we'll briefly touch on options trading

as well as some other features you might

care about like their cash management

where you can earn a high yield on your

uninvested cash we're also going to

cover how to withdraw money from Robin

Hood at the very end assuming you sell

some stocks for a profit or ETF for a

profit or maybe receive some dividends

and you're looking to cash that money

out real quick before we get started if

you could drop a like on this video it

will definitely help this video with

getting shared out with more people that

would be very much appreciated so if

you're looking to get that free stock

bonus you're going to want to use my

affiliate link which is going to be

ryan.com

start all you have to do is type that in

on your computer if you're watching this

on your phone or vice versa or it's

linked up in the description below at

this point it's going to ask us to

create a login now this isn't going to

be your full-blown Robin Hood investing

account this is just going to be your

login so you have a basic level account

so you're going to fill in here your

first name last name email address and

then your desired password now once

you've gone ahead and set up your login

just like I showed you you're going to

be brought over to this screen where it

says your investment Journey awaits and

you click on the black button here to

get the app and it's going to redirect

you to the App Store and whether you're

on Android or on iPhone phone it's going

to be slightly different but it's going

to be that same process from here you're

going to click on that install button

now in my case since I used to have a

Robin Hood account I'm just going to be

reinstalling it from the cloud but if

you are brand new it's just going to be

a regular install button now we're going

to click on the blue open button it's

going to bring us over to the Robin Hood

app now at this point Robin Hood is

going to ask you some information about

your address as well as your social

security number and this is something

required for the ayc or know your

customer laws and it's essentially for

the IRS reporting when you sell stocks

for capital gains or even potentially

earn dividends that is required to be

reported to the IRS and it also includes

earning interest if you use their high

yield savings so it is going to be

required just like any Financial account

or bank account I'm going to go ahead

and enter my address now and fill this

information in and you can follow along

step by step doing the same now once

you've gone ahead and filled in that

information it is going to ask you to

answer answer a few questions about

investing this is going to be regardless

of whatever investing account that you

open and it requires you to answer these

basic questions about your experience

and also some required insider trading

related questions we're going to go

through these together but it's nothing

to worry about the first question how

much investment experience do you have

it's none not much I know what I'm doing

or I'm an expert in this case I'm going

to say I know what I'm doing it now asks

you if you're employed unemployed

retired or a student in my case I am am

technically self-employed uh so there's

not really a great category for that but

I will just say employed and my employer

in my case is my business which is

Scribner media LLC once you have that

filled out we're going to click on that

black continue button and now we start

off with these required questions that

are basically about insider trading and

in most cases they're going to be a no

first question are you or a family

member a senior executive or 10%

shareholder at a publicly traded company

in most cases it's going to be a no

unless you know of somebody in your

family who's like Warren Buffett or

borne Buffett Jr who owns tons of shares

of a public company it's going to be a

no for us it then asks if you or any of

your family members work for a stock

exchange or brokerage so if they work

for the NASDAQ or New York Stock

Exchange or possibly Fidelity Schwab

different brokerages you'll probably

know if people are doing that in your

family in most cases that's going to be

a no and then at this point it's going

to have you do a required tax

certification this is just basically

signing saying that you verify your

information is correct here that you

supplied in terms of your address and

your Social Security number because you

are opening a taxable investment account

and down the line you might also decide

to open up the high yield savings

account with them for the interest on

your uninvested cash and we're also

going to touch on that retirement

account later so again this is just

certifying that you gave the correct

information and I'm going to click agree

and accept and at this point you are

going to review and accept for

electronic delivery as well as the terms

of service for Robin Hood now my

application here is currently under

review but yours should be available

instantaneously so at this point you

should be able to move on to the very

next step but if not there is going to

potentially be a short review period if

they aren't able to verify you

instantaneously let's go ahead and cover

how to link your bank account with Robin

Hood and it's all going to happen from

this person menu here on the bottom

right so we're going to click on that

first and then you're going to click on

the three lines here at the top left and

this is your menu where you access the

different settings what we're going to

do now is navigate over to transfers

where we have options for deposits

withdrawals and even brokerage account

transfers now at this point there is a

security protocol requiring me to turn

off my screen share which is new I'm

glad I'm walking through this with you

guys together here with a new updated

version of this just so you would know

what to expect so I'm going to turn that

off I will take some screenshots and put

those on screen here as we continue on

this screen here you have the option to

transfer money manage recurring deposits

send a wire transfer transfer accounts

and also see available with withdrawable

cash but what you're going to want to do

from here is scroll down and you'll see

the option here for your linked accounts

and this is going to have the option to

add a new bank account you're going to

go ahead and click on that button now

from here you have the option to do an

instant transfer using your debit card

with a up to 1K daily deposit limit it

would be instant if you're looking to

invest immediately or you can do a

Traditional Bank account link if we

click on debit card it's going to give

you the option now here of just entering

your debit card information but if you

instead wanted to link it with your bank

account you would do that with plaid

automatically by entering your login

information and then selecting your

account now that we're out of that

particular section I can do the screen

recording again thankfully and we're now

going to do a little bit of research in

the app and we're going to take a look

at some stocks and then we're going to

take a look at the crypto section and

then we're going to get into the actual

purchasing of an ETF and talking about

retirement account and some other

options like that just another quick

reminder here if you haven't already

make sure you drop a like And subscribe

with the Bell turned on for those future

notifications we're going to look at one

of the most popular which is NVIDIA and

if you know the stocks symbol you can

type that in but if you don't you can

just type in the name of the company so

I'm going to type in Nvidia and we can

see nvda is the particular symbol so we

click on that here and we can see that

Nvidia is actually available in the

Robin Hood 24hour market and that's

pretty cool because Robin Hood has

select stocks that they support trading

of 24 7 and it's similar to the crypto

markets which a lot of us are familiar

with I'm going to click on got it for

now and we can see that Nvidia is having

a really solid day today they're up

4.27% and you can click here and drag

your finger along and it shows you the

price over the day you can also change

the timeline down here and see over the

last week Nvidia is up 88.8% in the last

month 37 1/2% 3 months is 51% year-to

date 33.4 7 the one year is over 200% 5

year is like 1,00% and the maximum chart

is like 83,000 so if you invested in

Nvidia back in 2015 or something at five

bucks a share now you're looking at like

over 100x on your money there so man

that would have been a good investment

but anyway very tough in hindsight to be

aware of these things that early on but

individual stock selection is really not

recommended anyway in fact what most

people like Warren Buffett would suggest

is doing the I ified approach of

investing in the S&P 500 and once my

account is fully reactivated I'm going

to show you how to deposit money and

actually invest in the Vanguard S&P 500

ETF that Warren Buffett himself

recommends but just so you are aware

this is how you research stocks we're

going to scroll down here and we have an

about section where you can get some

information about the particular company

you can see the CEO employees the

statistics here show us some information

you might want to be aware of volume is

the total number of of shares that have

traded today the overnight volume is

most likely related to that 24-hour

market that Robin Hood offers and you

can compare the volume of the day to the

average volume and this can show you if

there's more or less people trading the

stock than normal below that we can see

the market cap market capitalization

this is the total value of the company

and you can then see the price to

earnings ratio this is the multiple that

people are paying on the current share

price relative to the company's earnings

so this is a relatively expensive stock

based on the fact that people are paying

about $83 in investment dollars today

for exposure to this company making $1

of annual earnings it might be a little

bit confusing to understand that I

actually have a full video on

fundamental stock analysis I'll put a

card in the corner if you'd like to

watch that as this will walk you through

these very important Financial metrics

in valuation metrics like the PE Ratio

below that we also have the dividend

yield here Nvidia does pay a very very

small dividend but it's coming in at

.3% so it's a minuscule amount of money

but if we look at a different stock I'll

just switch over to a a dividend payer

for example Johnson and Johnson and

we'll see looking at their particular

yield it's

2.97% in just real quick looking at

their PE ratio there's his 11.5 so in

the case of Johnson and Johnson

investors are paying about 1150 today

for exposure to $1 of their annual

earnings now it doesn't mean you're

going to get those earnings in your

pocket the only money you're getting in

your pocket is that dividend which in

this case is that

2.97% but it's important to understand

that stocks of different Industries will

have totally different normal valuations

so for example Healthcare which Johnson

and Johnson is a part of has a baseline

level price to earnings ratio which is

considered normal whereas in Tech and in

particular AI which would be the sub

segment there or industry that Nvidia is

involved with that is going to have a

much higher price to earnings ratio

that's Norm Al just based on the growth

potential that is priced into today's

numbers now again that's just some stock

market jargon that you probably don't

need to be aware of especially if you're

just looking to be a passive ETF

investor which is what's recommended but

you might just want to be aware of it

anecdotally just so you know some of the

basics back looking at Nvidia now we're

going to scroll down further and we can

see the news section so if you're

wondering hey why is Nvidia stock up 4

1/2% today we can look at any news that

came out surrounding them so we can see

wow look at that meta stock is actually

up 21% today and the news here is that

meta rolls out own AI chip to power

Facebook and Instagram targets Cost Cuts

and Nvidia Independence so that's pretty

crazy because they're actually looking

to I guess separate from Nvidia but even

despite that um you know Nvidia is still

doing really well today so if you want

to read into the article you can click

on that and it does it right in the

Robin Hood app it's super clean for just

getting upto-date info on stocks and

below that we have the analyst ratings

so if you are looking to get the Wall

Street professional opinion on a

particular stock or even a fund you can

come down here and see what they say in

this particular case among 53 analyst

ratings 92% say it's a buy 8% say it's a

hold and 0% say it's a sell you can also

see what the bullish thesis as well as

the bearish thesis is and that's going

to be sort of the professional opinion

on why the stock could go up in the

future or why it could be overpriced

today and why it could go down so if you

were looking to invest in an IND idual

stock you'd want to fully understand

both of the cases here and see if the

risk reward potential made sense for you

if you're looking for individual stock

ownership now if you're looking to get

more info here you can click on show

more and it gives you a bit more info on

that they do offer professional research

reports that come as part of Robin Hood

gold that is going to be a separate

package that we will talk about later on

but I don't personally use it I have in

the past but we'll talk about what that

is in case you're interested below that

we have the earnings chart and this

shows us us the quarterly earnings over

time on this chart here it's showing us

what the expected EPS or earnings per

share were versus the actual EPs and

what we can see here as the trend is

that Nvidia has been beating those

Expectations by a wider and wider margin

it looks like and that's probably why

the stock has gone up so much so they

have expected figures that's basically

like these professional analysts and

think of it like um horse racing where

you have people who are like

handicappers and they know what they're

doing and they have these statistics in

mind in the same manner you have these

people putting out these estimates on

what they think the company's going to

do in that Financial quarter and based

on the consensus Nvidia has been doing

above those expectations over time here

now if you're looking to get ideas on

other stocks through the app they have

lists here like most popular stocks you

can also look at what stocks are in the

24-hour market we'll take a look at that

is it's relatively interesting and

there's 225 particular items here so if

you wanted to look at what stocks were

supported here you could scroll through

all of these yourself at the bottom

there's also this people also owned

section where you can see related

companies such as AMD Microsoft meta and

this could just give you an idea of

other companies in that particular

industry what we're going to do now is

explore the crypto section of the app

and as mentioned before this is a

separate legal entity that runs the

Robin Hood crypto section and there will

be a separate set of disclosures that

you will have to go through if you want

to do this yourself within the app so

what you're going to do here if you're

interested is go to the search bar just

like before and this is going to give

you a list of um you know popular

cryptos based on 52e highs lows Etc but

if you had a particular asset in mind

such as Bitcoin and then you can see we

have Bitcoin Bitcoin cash Bitcoin gold

we're going to go ahead and click on

bitcoin and if you wanted to go ahead

and trade crypto through the Robin Hood

app you could do so here now Robin Hood

does also offer a wallet now which

allows you to send and receive

cryptocurrencies however there is

additional verification and a layer of

two-factor authentication that has to be

added but you are able to do that if you

want to send and receive crypto similar

to the coinbase wallet so I'm not

personally going to invest in Bitcoin

using the Robin Hood app but you could

do so if you're looking to do it in one

convenient place and just like before

you can use the chart here and look at

the performance of Bitcoin for example

over the last year it's up about 82% now

let's go ahead and talk about the

retirement accounts as this is one of

the biggest pieces of news surrounding

Robin Hood in recent years because these

retirement accounts that they offer are

pretty slick if you're looking to invest

for the super longterm and take

advantage of compound interest without

worrying about taxes something like a

Roth IRA is a really solid option and

that's now available through Robin Hood

we're going to scroll through here and

just take a look at some of the options

here in the tiles I don't have a

full-blown retirement account set up

with them but if you wanted to it can

all be done Under One Roof and we're

also going to talk about a contribution

match that they offer which is rather

unheard of if you have Robin Hood gold

which is their paid subscription plan

they offer a 3% extra match on top of

your contributions to your retirement

account which is pretty insane now you

do have to pay for Robin Hood gold I'm

going to show you that shortly but if

you are maxing out your contributions

for example it might be worth it if you

you know run the numbers and see what

that cost ends up being but even if you

don't have Robin Hood you would still

get a 1% match on top of what you

contribute so if you're looking to

invest with a Roth IRA and maximize

those contributions you can get an extra

1 to 3% bonus on top of what you put in

simply using Robin Hood they also have

recommended portfolios if you don't want

to be fully in control yourself which is

a really cool option and of course it's

all going to be in a tax advantaged

manner so myself I would personally

suggest that you get started on the

Robin Hood investment side with your

taxable brokerage account get familiar

and then think about setting up a

long-term investment goal here and use

the retirement section of the app for

that another feature you might want to

take advantage of is the Robin Hood cash

card if you're looking to use the money

in your Robin Hood account in the form

of a debit card so they really do have

all of the bases covered now in terms of

your entire Financial life you could do

it all pretty much within Robin Hood At

this point if you wanted but a couple of

options that they have here is you can

invest your spare change similar to the

acorns round up they're also going to

allow you to invest a part of every

paycheck automatically no hidden fees

and then cash back when you spend there

is currently a weit list there but if

you were interested you could jump on

that and you could be among the first to

get that when those cards become

available and then as far as earning a

high yield on your savings they offer a

cash sweep program where you can have

your uninvested cash swept over into a

separate high yield savings account

currently this pays a 5% apy which is

about 8 times higher than average of

what you're seeing out there so if you

wanted to earn a high yield right within

your Robin Hood account on your

uninvested cash you can do so with Robin

Hood cash sweep all righty guys so we're

going to finish things off in my

fiance's Robin Hood account just because

my Robinhood account was pending

reverified to keep the video rolling

here the only thing we couldn't show you

here was the free stock since I'm not

going to get it until my account

reactivates officially here's the

details of the Hood free stock and this

is going to be linked up down in the

description below if you want to check

it out yourself basically you're going

to be getting a dollar value which

ranges from $5 to $200 and it's going to

be random however 98% of people get a

value between $ and $10 for their reward

now from here you get to actually pick

your stock from a list of 20 of

America's leading companies so whether

you wanted Tesla or different companies

like that for example you can choose

which company you invest in with that

reward based on using fractional shares

as far as selling the free stock goes

you're able to sell it three trading

days after claiming it however if you

want to actually withdraw that money to

your bank account you are going to have

to wait at least 30 days after claiming

it but what you could do is sell that

stock and then use that money to invest

in whatever stock or ETF that you would

actually like to own now right now in

the app it's showing $0 in buying power

but we're going to go ahead and click

here and it's going to allow us to

deposit funds and I showed you how to

link that bank account earlier so

assuming you completed that step you'll

be able to deposit funds at this point

we're going to click on the black

deposit funds button and I'm going to

deposit $10 from this particular bank

account and then we're going to click on

review and then transfer $10 at this

point it's going to show us a timeline

here for the deposit so it shows it was

initiated today on February 2nd and it's

going to be available to trade and

withdraw by February 5th we're going to

click on the continue button now however

the cool thing about Robin Hood is they

do offer this instant deposit feature

which means you can invest your money

early as long as you don't sell that

particular asset before your new deposit

settles now I'm going to show you how to

invest in the S&P 500 using the Vanguard

ETF and we have $10 of buying power but

we are going to be able to do that

thanks to the fractional share investing

we're going to click on search here and

now we're going to type in the Vanguard

S&P 500 and it's actually going to be

the very top search there in most cases

when you type in Vanguard but it's the

Vanguard S&P 500 ETF under the symbol vo

we're going to click on that and it also

shows us this is available in that

24hour market which is really cool if

you want to do some research on this ETF

just like before you can scroll down and

get information on it it's pretty cool

here because this will show us some

different visuals here on the ETFs than

you would have seen looking at the

stocks so we can see here that the index

is tracked by the S&P 500 it also has 8

underlying Holdings so you have

diversification built in among 500 of

the largest US companies the Inception

date of September 2010 and it's also a

large blend so it's a mix of large

companies you can also see what sectors

are represented in this as well as the

top 10 Holdings so if you invest in vo 7

cents on every dollar is going into

Apple you also have a lot of money going

into Amazon Google birkshire Hathaway

Microsoft Nvidia meta Tesla JP Morgan

Etc but it's really cool to see this

visual breakdown here of what your money

is going into and how you have this

diversification built in you can also

see the average historical return here

and that can be helpful too in just

gauging The Benchmark but in terms of

investing in a diversified manner this

is what Warren Buffett recommends

investing in a low fee um S&P 500 Index

Fund or in this case it's just an

exchange traded fund we're going to

click on the green buy button and at

this point we have options here of

buying shares but if I wanted to buy a

whole share it's going to be

$453 which I don't have in the account

but if I click here we can actually

change it to buying in dollars and this

is going to allow you to invest with

dollars instead of buying whole shares

so what I can do here is put $10 at this

point into the S&P 500 and I'm actually

buying

02 2036 shares of VO we're going to

swipe up and that is going to be

received and then just like that the

order is completed so if I click on view

order it's going to show us that it was

filled it was February 2nd 2024 $10 and

we can see that the value was $

45384 per share at the time of purchase

now if we go back to vo and scroll down

you can see my position is listed here

you can see my number of shares as well

as the total return and things like that

so if you wanted to continue investing

over time you could do that right here

within the app or you could also set up

a recurring investment into something

like the S&P 500 or other Investments if

you wanted to do so and all of that

would be happening right over here by

clicking on the person icon and then

going over to these multiple lines right

now I don't have any recurring

Investments enabled but if you click on

view recurring Investments you could

create a recurring investment here to

automatically invest in something like

the S&P 500 ETF the last thing I want to

cover here quickly is options it's

disabled by default but if you wanted to

do options trading you can click on

enable options trading I'm just going to

click on learn more just so I can tell

you a bit about it there are no

commission fees to buy or sell options

or monthly fees with Robin Hood however

it is extremely risky territory for

investors so you have individual stocks

which are high risk and then you have

options which is just risk piled on top

of risk so it's really not for those who

are in experienced but if you did want

to explore them it is here in the app um

you have basic call options and put

options and you can also get into more

advanced options strategies if you want

to enable them in the app as they have

different levels available for their

options trading and let's say you want

to go ahead and sell a particular asset

what you would do is click on the trade

button and now you have the option to

sell and this is where you could put in

the dollar value you're looking to sell

so I could sell that 101 available if I

wanted to I'm not going to just because

it really wouldn't make sense but if you

wanted to you could immediately sell and

there are no trading commissions there

are some small fees that you do pay like

you know fractions of a penny that go to

finra and different Regulatory Agencies

but there aren't any trading commissions

that go to Robin Hood so there you have

it guys that's going to wrap up this

beginner's guide to Robin Hood investing

I hope it helps you to get started on

your investing Journey like I said if

you want to go ahead and grab that free

stock offer you have the top link down

in the description below or once once

again it's ryan.com start and that is an

affiliate link so we will earn a

commission through investing simple if

you decide to use that link there's also

the full article in the description

about the Robin Hood free stock if you

want more information on that finally if

you are looking to learn how to get

started with your side hustle I do have

a book out there from side hustle to

main hustle to millionaire which is a

step-by-step guide on how to get started

with your very own income stream outside

of working a job or anything like that

and it tells you about how I did this

myself starting off as a utility worker

and then quitting my job and then

building up these various digital income

streams just like the investing simple

blog becoming a millionaire in the

process and all of the steps involved so

if you guys want to check that out

that's going to be available in person

at Barnes & Noble stores it's also at

libraries across the United States you

can find it on Amazon as well as an

author narrated version on Audible

thanks so much for tuning in if you're

looking to learn more about this stock

market you can click below to watch my

3-hour stock market for beginners course

and I'll see you there

5.0 / 5 (30 votes)

FREE writing software | Longform and shortform

6款工具帮你自动赚钱,轻松上手帮你打开全新的收入渠道,赚钱效率高出100倍,用好这几款AI人工智能工具,你会发现赚钱从来没如此简单过

不露脸YouTube新手做什么类型视频最好!28个低调的网上赚钱视频领域大揭秘,自媒体拍什么类型的视频比较好?看完你就有答案

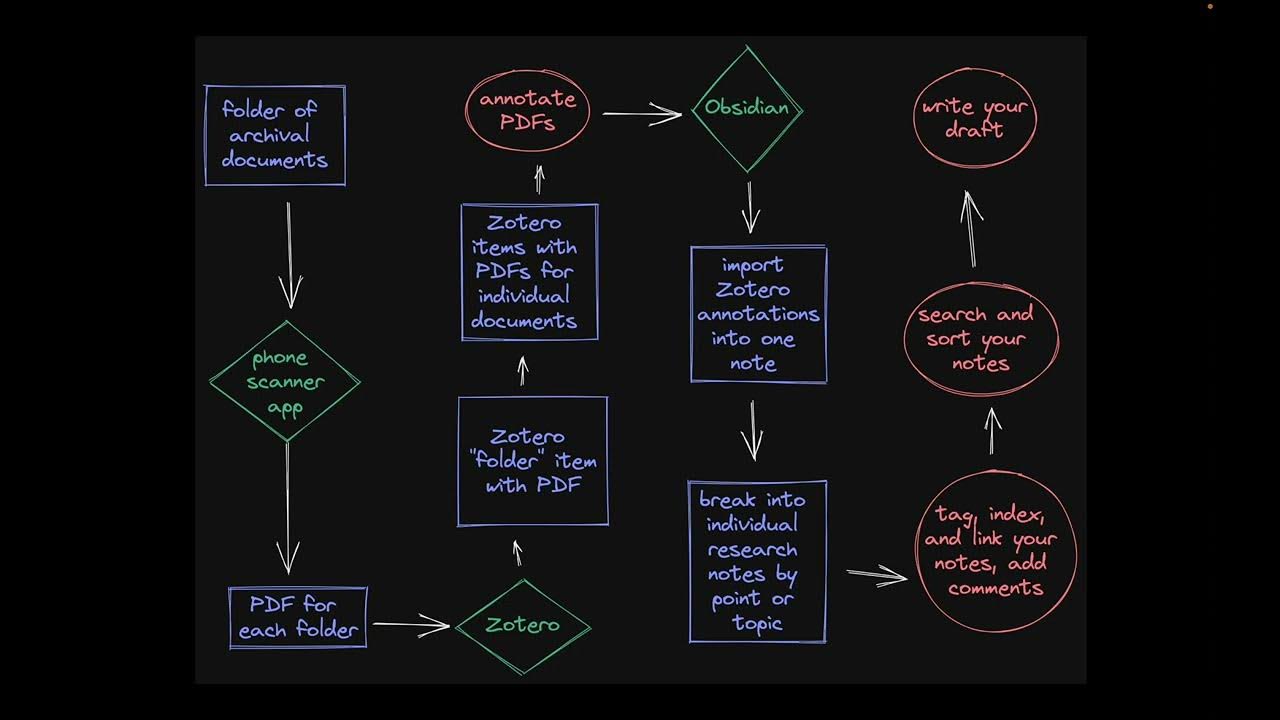

Doing History with Zotero and Obsidian: Archival Research

2023年如何從0-1做一個賺錢的小紅書,月入1萬+美金|快速起號攻略分享 帳號定位/對標帳號/選題/數據分析 Make money with Red

From GhostNet to PseudoManuscrypt - The evolution of Gh0st RAT - Jorge Rodriguez; Souhail Hammou