Warren Buffett shares advice on becoming successful

Summary

TLDR在这段视频中,沃伦·巴菲特分享了他对真正成功的定义,即到了晚年,如果你拥有你所希望得到爱的人的爱,那么你就是一个成功的人。他强调了自我投资的重要性,尤其是沟通技巧,认为这是提升个人价值的关键。巴菲特还提到了照顾好自己的身体和心灵,以及选择正确的人际关系和效仿对象的重要性。他建议人们应该与比自己更优秀的人交往,并谨慎选择自己想要效仿的人。在投资方面,他批评了频繁交易的行为,并建议人们应该像购买农场或公寓一样,长期持有投资。巴菲特还分享了他的一些个人习惯,包括他的早餐选择、对健康的看法、以及他携带的现金数量。此外,他还谈到了对商学院教育的看法,认为这取决于个人的兴趣和需求,并非每个人都需要上大学。最后,巴菲特还提到了他的一些个人喜好,包括他最喜欢的歌曲、电影、书籍以及电视节目。

Takeaways

- 😀 成功的定义:沃伦·巴菲特认为,如果你在65岁或70岁以后,那些你希望爱你的人真的爱你,那么你就是一个成功的人。

- 🏆 财富与幸福:巴菲特指出,他从未见过一个拥有许多人爱戴的人是不幸福的,而一些非常富有的人却没有人爱。

- 💰 投资自己:巴菲特强调,对自己进行投资是最好的投资,比如提高沟通技巧,可以显著提升个人价值。

- 🗣️ 沟通技巧:巴菲特建议,无论是写作还是口头表达,良好的沟通能力对成功至关重要。

- 🚗 照顾自己:巴菲特比喻说,我们应该像照顾一辆车一样照顾自己的身体和心灵,因为这是我们在这个世界上唯一的身体和心灵。

- 🤝 选择伙伴:巴菲特认为,选择与谁交往非常重要,应该选择比自己更优秀的人作为榜样和伙伴。

- 👫 配偶选择:巴菲特提到,选择一个比自己稍微优秀的配偶非常重要,这将影响你的生活方向。

- 💡 投资智慧:巴菲特警告,不要因为可以频繁交易就频繁交易,长期投资通常比短期交易更明智。

- 🍔 早餐习惯:巴菲特透露,他的早餐习惯很简单,喜欢吃他从小就喜欢的食物,如热狗、汉堡、可乐和冰淇淋。

- 🎓 教育价值:巴菲特认为,商学院是否值得上取决于个人,并非每个人都需要上大学。

- 🎵 音乐品味:巴菲特最喜欢的歌曲是《My Way》,这反映了他的个性和生活哲学。

- 🎬 电影选择:巴菲特最喜欢的电影是《桥》,因为它包含了许多人生的教训。

- 📚 书籍推荐:巴菲特推荐《聪明的投资者》这本书对他的生活影响最大。

- 📺 电视节目:巴菲特最喜欢的电视节目是Nebraskans,这可能反映了他对体育的热爱。

- 👛 钱包内容:巴菲特通常携带大约400美元现金和一张自1964年以来使用的美国运通卡,他更喜欢用现金支付。

Q & A

沃伦·巴菲特如何定义真正的成功?

-巴菲特认为,如果你到了65岁或70岁,那些你希望爱你的人确实爱你,那么你就成功了。他从未见过有人因为拥有很多人的爱而感到不快乐,即使他们非常富有。

巴菲特给想要在商业上成功的人哪些建议?

-巴菲特建议投资自己,比如提高沟通技能,无论是书面还是口头,都能显著提升个人价值。他还提到,如果你拥有一辆车,并且这是你一生中唯一的车,你会非常小心地维护它,同样,我们只有一副身体和一颗大脑,应该好好照顾它们。

巴菲特认为生活中最重要的建议是什么?

-巴菲特认为,与谁交往是最重要的。你应该与比你更优秀的人交往,因为你将会朝着你交往的人的方向前进。他还强调了选择正确的榜样和配偶的重要性。

巴菲特认为人们在投资时犯的最大错误是什么?

-巴菲特认为人们犯的最大错误是频繁交易。他们认为因为可以交易就应该交易,但巴菲特建议买入并持有,就像你买农场或公寓一样,不应该期望立即转手。

巴菲特的早餐习惯是什么?

-巴菲特的早餐习惯很简单,他吃他喜欢的食物,比如热狗、汉堡、可乐、冰淇淋和巧克力,这些都是他六岁生日时喜欢的食物。

巴菲特如何看待商学院的价值?

-巴菲特认为商学院的价值取决于个人,而不是学校。他不认为每个人都需要上大学,因为有些工作不需要大学教育,而且他本人对上大学也没有太大兴趣。

巴菲特最喜欢的歌曲是什么?

-巴菲特最喜欢的歌曲是《My Way》。

巴菲特最喜欢的电影是什么?

-巴菲特最喜欢的电影是《桥》(The Bridge on the River Kwai),因为电影中的教训和音乐都很吸引人。

巴菲特最喜欢的书是哪一本?

-对巴菲特影响最大的书是《聪明的投资者》(The Intelligent Investor),作者是本杰明·格雷厄姆。

巴菲特最喜欢的电视节目是什么?

-巴菲特最喜欢的电视节目可能是Nebraskans,他提到了超级碗的获胜。

巴菲特通常携带多少现金?

-巴菲特通常携带大约400美元现金,并且他几乎总是用现金支付,除非是逮捕时。

Outlines

😀 成功的定义与个人投资

在第一段中,沃伦·巴菲特(Warren Buffett)分享了他对真正成功的定义,认为在65或70岁时,如果你拥有你所希望爱的人的爱,那么你就成功了。他强调了人际关系的重要性,并提到即使非常富有的人,如果没有人爱他们,他们也不会感到幸福。巴菲特给出了三条商业成功的建议:首先,投资于自己是最佳选择,特别是提高沟通技巧;其次,要像对待唯一一辆车那样照顾自己的身体;最后,选择与比自己更优秀的人交往,这对个人发展至关重要。他还提到了配偶选择的重要性,认为选择一个比自己稍好的伴侣非常重要。

😀 投资智慧与生活哲学

第二段中,巴菲特讨论了人们在投资时犯的一些常见错误,比如频繁交易而不是长期持有。他建议人们应该像购买农场或公寓那样投资,而不是被流动性和短期成本所迷惑。巴菲特还分享了他的早餐习惯,他喜欢简单的食物,比如热狗、汉堡、可乐和冰淇淋,并且他不打算改变这些习惯。此外,巴菲特还谈到了教育的价值,他认为不是每个人都需要上大学,应该根据个人兴趣和职业目标来决定。他还分享了自己的一些个人喜好,包括最喜欢的歌曲、电影、书籍和电视节目,以及他通常携带的现金数量。

Mindmap

Keywords

💡成功

💡投资自己

💡身体健康

💡人际关系

💡投资

💡早餐习惯

💡教育

💡歌曲《My Way》

💡电影《桂河大桥》

💡书籍《聪明的投资者》

💡携带现金

Highlights

真正的成功定义:当你65岁或70岁以后,你希望爱你的人真的爱你。

巴菲特认为,拥有许多人爱比财富更重要。

最好的投资是投资自己,特别是沟通技巧。

沟通能力可以至少提升个人价值50%。

投资于自己,别人无法夺走。

对待身体就像对待唯一的一辆车,要细心维护。

选择与比自己更优秀的人交往,他们会引领你前进。

选择正确的榜样和配偶至关重要。

投资时,人们常犯的错误是频繁交易而不是长期持有。

巴菲特的早餐习惯:只吃自己喜欢的食物。

巴菲特不认为每个人都需要上大学。

巴菲特本人对大学教育的看法。

巴菲特的喝水习惯:只有在迫不得已的情况下才会喝水。

巴菲特最喜欢的歌曲是《My Way》。

巴菲特最喜欢的电影是《桥》。

对巴菲特影响最大的书是《聪明的投资者》。

巴菲特最喜欢的电视节目是Nebraskans。

巴菲特通常携带大约400美元现金。

Transcripts

Warren how would you define true success

well I've said many times that that if

you get to be 65 or 70 and later and and

the people that you want to have love

you actually do love you you're a

success I've never seen anybody that

reaches that age I mean I'm not talking

about somebody that's extreme poverty or

painters I'm gonna never seen anybody

that if they have a lot of people that

love them that there's other than happy

and I've seen some very very wealthy

people that they can testimonial dinners

doing named schools have sir and

everything there is nobody nobody loves

him you know their own kids would say

he's in the Attic he's in the Attic you

know okay what are say three pieces of

advice you would give to people who are

looking to succeed in business well I

by far the best investment you can make

is in yourself I mean that for example

communication skills I tell the students

that come that they're going to graduate

schools and business and they're

learning all these complicated formulas

all that if they just learned to

communicate better and both in writing

and person they increase their value at

least 50% no I mean if you can't

communicate somebody he says you know

it's like winking at a girl the dark

nothing happens you know basically and

and you have to be able to get get both

your ideas and and that's that's

relatively easy I did it myself with a

Dale Carnegie of course some people wish

I'd take it a shorter course not by

talking later on but it it's just hugely

important and you if you invest in

yourself nobody can take it away from

you I mean you and the second thing

which I'll get a certain criticism for

not living it but but I do tell the

those students you know that if I gave

you a car and it'll be the only car

you're getting them rest of your life he

take care of it like you can't believe

and he scratch you'd fix that moment you

read the owner's manual you keep it

garage into all these things and you get

exactly one mind of one and one body in

this world and and you can't start

taking care of it when you're 50 by that

time you little rust it out if you

haven't done anything so you know you

should

is really make sure that you just

remember that you just got one minor

body to get through life with him did it

do the most with it what about life

advice

well I've advises you know the most

important thing aside from the things

I've talked about already is it's really

who you associate with you want to

associate with people that are better

than you are

I mean basically you'll go in the

direction of the people that you

associate with and and you want to have

the right heroes you want people if you

want to emulate somebody you better pick

very carefully who you want to emulate

and and when obviously you can't pick

your parents they're gonna have an

enormous influence on you but you don't

get a choice on that but you get choices

as you go down the line and you who you

who you admire who you who you want to

copy and the most important for most

people in terms of that decision is

their spouse it's also important to in

terms of a partner in business but the

partner in life is is the most important

you'll you want to pick a spouse that's

little better than you are and then he

or she and you hope they don't figure it

out too fast

great biggest mistakes people make when

investing well they they try to but they

they just don't realize that all you

have to do is just buy across the shin

of America and they never listen to

people like me or read the papers or do

anything subsequently they think they

think that because you can trade you

should trade they but you buy a farm you

buy an apartment house so you can't

resell it tomorrow I don't know the

costs of moving around or you now you

get something handed to you liquidity

you know which is instant and so and the

the cost of doing it or pennies you know

compared to other kinds of investment

activity so because they can so easily

move around they do move around and

moving around is not smarter than

investing you have a pretty cool morning

routine regarding what you have for

breakfast and how prosperous you feel

what is that well that way and and I was

actually send somebody over to them now

to get me something since since I sent

the publicity I

from earlier describing my habits at

McDonald's hey I know somebody happened

had somebody go in the office but that

was that was a more for entertainment

value I I actually I eat exactly what I

like to eat yep

if I liked it on my sixth birthday and

my sixth birthday party when we had hot

dogs and hamburgers and coke and ice

cream with chocolate I still like it and

I don't care about anything subsequently

that I discovered it all by the time I

was six and if somebody offered me a

deal when I was 20 and said you're gonna

live one year longer you know instead of

living to 88 you lived 89 or whatever it

may be if you eat nothing but broccoli

and Brussels sprouts and onions and all

these things and I I didn't take the

last year off it probably won't be that

good anyway you know I Manso I eat what

I like the III

I I am NOT venturesome in that area

like how you lumped in onions with

broccoli and Brussels sprouts never

heard them I just don't have like onions

I don't put them in the same category

you and George HW Bush I think it's

Business School worth it depends on the

person and much more than it depends on

the school I mean I wouldn't worry some

people are gonna get a lot out of

advanced education and some people are

gonna get very little and I don't even

think it's important that every person

go to college at all I'm you know we

have all kinds of jobs at 70 or so

thousand a year eighty thousand a year

that college training is is not abuse

and and I actually was not keen on going

to college myself yeah my dad kind of

jolly man when he can get me to do

anything but and if they'd had an SAT

test those days he would have taken the

test for me yeah but but because I just

I was I knew I could have a good time

and I liked investing and I didn't

really feel like I could read the books

so I don't you know it's it's a big

commitment to take four years and the

cost involved and maybe the loans

involved that everything I think

depending on

what your interests are in life I don't

think I don't think it's for everybody I

think it's for a lot of people but there

ought to be a reason you're going and I

didn't really see much reason

all right last questions the lightning

rounds there's a few do you ever drink

water only under duress what is your

favorite all-time song it's undoubtedly

it's my way

what about movie favorite movie well I

like the Bridge on the River Kwai

because of the lot there were a lot of

lessons in that pleasant was a you know

enormous Lee fascinating catchy tune

also catchy tune also the ending of that

was sort of the story of life you know

he created the railroad the enemy did

come in across it you know it got it

favorite book well the favorite book

from the best book that had the most

impact on my life was the Intelligent

Investor by bedroom I knew you were

gonna say that

favorite TV show it's probably going to

be Nebraskans some huge bowl gave him

winning and finally what are you carry

in your wallet and how much money do you

tend to carry around well I probably

carry maybe $400 oh yeah I actually my

what my wife likes to use a cash so I

just take home a chunk of cash every now

and then she doles it out she looks at

my billfold and sees whether all the

hundreds are gone six of you it's pretty

simple and a credit cards I've got an

American Express card which I got in

1964 but I I pay cash 98% of the time if

I'm an arrest always pay cash it's just

easier Warren Buffett thanks very much

5.0 / 5 (0 votes)

不露脸YouTube新手做什么类型视频最好!28个低调的网上赚钱视频领域大揭秘,自媒体拍什么类型的视频比较好?看完你就有答案

在法国抓野鸡,一个笼子一把鸟食就能成功,森林猎人就是我!| 山鸡 | 狩猎 | 户外 | 田园 | 法國 | 美食 |

6款工具帮你自动赚钱,轻松上手帮你打开全新的收入渠道,赚钱效率高出100倍,用好这几款AI人工智能工具,你会发现赚钱从来没如此简单过

Website Design Process for Clients (Start to Finish)

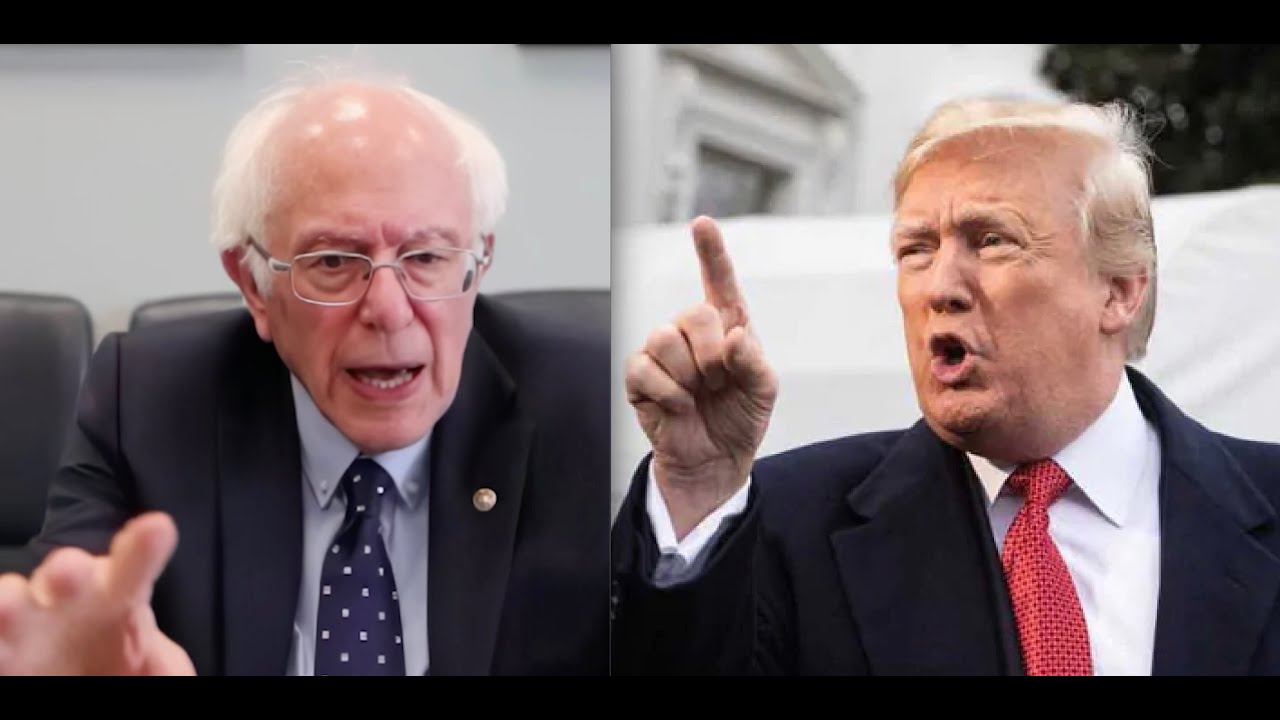

🚨 Bernie Sanders issues BAD NEWS for Trump ahead of election

My First Day Living In Africa! *Nigeria*