Trading Triumphs - Jerry Parker #3: The Dangers of Optimization

Summary

TLDRВ этом видео Джерри Паркер, опытный трейдер, обсуждает проблему переоптимизации в торговле и делится своим опытом, в том числе и неудачами. Он подчеркивает важность простоты и долгосрочного подхода, а также разнообразия рынков и систем для устойчивых результатов. Джерри также отмечает, что ключ к успеху - это строгое следование системе и удержание трендов, а не постоянное изменение стратегий на основе короткосрочных колебаний рынка.

Takeaways

- 🚀 Оптимизация и переоптимизация: Jerry Parker поделился своим опытом и последствиями переоптимизации в торговле.

- 📈 Динамичность стратегий: Рассмотрены различные стратегии с разными периодами, чтобы избежать переоптимизации и повысить робастность.

- 🔄 Распределение рисков: Важность диверсификации и распределения рисков через торговлю на разных рынках и с использованием разных систем.

- 📊 Игнорирование эквити-кривых: Фокус на торговых статистистиках, таких как средний выигрыш и потеря, вместо стремления сгладить эквити-кривую.

- 🛑 Ограничение переоптимизации: Избегайте добавления слишком много правил и параметров, чтобы упростить систему и обеспечить более надежную торговлю.

- 🔄 Множественные системы: Используйте несколько систем с разными параметрами входа и выхода для увеличения диверсификации и снижения переоптимизации.

- 💡 Соблюдение системы: Важность строгого соблюдения торговой системы и дисциплины вместо непрерывного поиска совершенства через переоптимизацию.

- 📉 Управление снижением: Разумное управление снижением размера позиции при неудачных сделках, чтобы продолжать торговать и избегать пропуска сделок.

- 🌐 Торговля на разных рынках: Торгуйте на множественных рынках, таких как акции, товары, валюты и криптовалюты для увеличения возможностей и диверсификации.

- 🔄 Важность выхода из сделки: Выявлено, что выход из сделки имеет большее значение для диверсификации и прибыли, чем вход в сделку.

- 🎣 Терпение и доверие к рынкам: Важность терпения и доверия к рынкам на долгосрочной основе, а не постоянных попыток максимизировать прибыль через переоптимизацию.

Q & A

Чем оптимизация может быть опасной для трейдеров?

-Оптимизация может привести к переобучению и использованию стратегий, которые хорошо работали на исторических данных, но могут не сработать в будущем. Это может вызвать непредвиденные плохие результаты, что было опытом Джерри.

Какие были первые шаги Джерри в трейдинге?

-Джерри начал с успешных первых четырех лет трейдинга, а затем продолжил успехи в течение 8-10 лет, пока не столкнулся с проблемами из-за переоптимизации.

Что такое переоптимизация и как ее избежать?

-Переоптимизация - это когда трейдеры слишком сильно манипулируют параметрами системы, чтобы улучшить результаты на исторических данных. Избегать ее можно, используя несколько систем с разными параметрами и не пытаясь усовершенствовать каждую из них до предела.

Какой подход к оптимизации Джерри рекомендует?

-Джерри рекомендует минимизировать оптимизацию, используя несколько систем с разными входами и выходами, но без чрезмерного изменения параметров. Он также фокусируется на статистике сделок, таких как средняя выигрыш и убыток.

Почему Джерри считает неважным корреляцию при трейдинге?

-Поскольку корреляция не дает точной информации о том, когда следует выходить из сделки. Важнее разнообразие выходов, которые могут привести к разным результатам и улучшить общую прибыль.

Какой совет дает Джерри для успешного трейдинга?

-Джерри советует оставаться верным системе и не пытаться управлять рынком. Он подчеркивает важность дисциплины и последовательности в выполнении системных правил.

Какие средства общения предпочитает Джерри для обмена опытом и знаниями?

-Джерри предпочитает использовать Twitter и Twitter Spaces для общения и обмена опытом с другими трейдерами. Он также проводит еженедельные встречи в Twitter Spaces.

Какой был опыт Джерри с оптимизацией после неудачных месяцев?

-Джерри испытывал плохие результаты после оптимизации, и он быстро прекратил использовать новые правила, которые привели к неожиданно плохим результатам. Он вернулся к более простой и надежной системе.

Чему научил себя опыт оптимизации Джерри?

-Он понял, что слишком много правил и параметров может сделать систему менее надежной и более уязвимой для переоптимизации. Он также осознал важность простоты и последовательности при выполнении систем.

Какие выводы делает Джерри о роли трейдера на рынке?

-Джерри считает, что трейдер должен полагаться на рынок и не пытаться вмешиваться в его тенденции. Успех зависит от правильного использования возможностей, которые предоставляет рынок.

Какой совет Джерри дает по управлению рисками при трейдинге?

-Джерри рекомендует уменьшить леверидж, если требуется, но при этом не пропускать ни одну сделку по системе. Это позволяет сохранить возможность выиграть, когда рынок дает возможность.

Какие личные успехи приписывает Джерри своим методам трейдинга?

-Джерри приписывает свои личные успехи, включая покупку недвижимости и лодок, тому, что он держался долгосрочных трендов на рынке и не спешил выходить из сделок.

Outlines

📈 Обсуждение оптимизации и ее негативных последствий

В данном разделе Джерри Паркер, участник трейдинг-подкаста, делится своим опытом в области оптимизации и переоптимизации торговых систем. Он рассказывает о своем путешествии к успеху, а также о том, как попытки улучшить торговые стратегии могут привести к неожиданным и плохим результатам. Основная проблема, о которой говорит Джерри, заключается в том, что переоптимизация может привести к ухудшению результатов на реальном рынке, и вместо этого лучше следовать простым и проверенным методам, которые с течением времени могут оказаться более надежными.

🤔 Как избегать переоптимизации и подходы к диверсификации

В этом разделе Джерри Паркер обсуждает, как избежать переоптимизации и сохранить эффективность торговых систем. Он предлагает использовать несколько различных систем с разными периодами времени, таких как краткосрочные, среднесрочные и долгосрочные стратегии, чтобы создать диверсификацию. Также он подчеркивает важность простоты и не перегруженности системой, что делает их более надежными и упрощает процесс принятия решений. Вместо того чтобы стремиться к идеальным результатам, лучше сосредоточиться на здоровых торговых статистиках и принятии рыночных колебаний с достоинством.

🔄 Разнообразие входов и выходов в торговых системах

Джерри продолжает обсуждение многообразия в торговых системах, особенно в отношении входов и выходов. Он подчеркивает, что все системы, даже если они входят и выходят из рынка в один и тот же момент, могут приносить прибыль, если они следуют своим правилам. Однако, когда дело доходит до выхода из позиции, различные системы могут давать существенно разные результаты. Это означает, что фокусирование на разнообразии выходных точек может принести больше пользы, чем излишняя оптимизация входных условий. Основная идея заключается в том, чтобы не пытаться контролировать рынок, а лучше довериться своим системам и их способности приносить прибыль в долгосрочной перспективе.

🚫 Не перегружайте торговые системы слишком многими правилами

В заключительной части обсуждения оптимизации Джерри Паркер подчеркивает, что перегружение торговых систем слишком многими правилами и условиями может привести к их нерациональной работе. Вместо этого, он предлагает использовать несколько простых систем с минимальным количеством правил, что обеспечит их более надежную и эффективную работу. Он также подчеркивает важность простоты и удесятеричения правил, что поможет избежать излишней оптимизации и повышает шансы на успех. В целом, Джерри рекомендует оставаться простом и не пытаться управлять рынком, а следовать своим системам и их результатам.

🎣 История успеха и ценность долгосрочной стратегии

В заключительной части разговора Джерри Паркер делится своим личным опытом и успехом, который он достиг благодаря долгосрочным торговым стратегиям. Он подчеркивает, что ключ к успеху заключается в том, чтобы доверять рынкам и их способности приносить прибыль в долгосрочной перспективе. Джерри также отмечает, что важно не пытаться управлять рынком, а просто следовать своим системам и правилам. Он утверждает, что даже среднестатистический трейдер может достичь успеха, если он будет последовательно придерживаться своей стратегии и не будет пытаться выжимать максимальную прибыль из каждого сделки.

Mindmap

Keywords

💡трейдинг

💡оптимизация

💡overoptimization

💡трading systems

💡risk management

💡diversification

💡drawdowns

💡whipsaws

💡Ten Commandments of trend following

💡backtesting

💡trade statistics

Highlights

The dangers of over-optimization in trading and how it can lead to unexpected negative impacts on trading results.

Jerry's personal experience with over-optimization, resulting in a significant drawdown in performance.

The importance of simplicity in trading systems and the potential pitfalls of adding too many rules or parameters.

How diversifying across multiple trend-following systems can help mitigate the risks of over-optimization.

The focus on trade statistics like average win/loss and win percentage, rather than equity curve or volatility.

Jerry's approach of using a few simple systems across various markets and time horizons to increase diversification.

The value of having multiple entries and exits within a strategy to add diversification without over-complicating the system.

The importance of always following your system, even if it means taking small losses consistently.

The benefits of having a cutback rule to reduce position size during drawdowns, while still executing all trades as per the system.

The correlation between different trend-following systems and how it can be misleading in terms of diversification.

The key takeaway that the exits in a trend-following system have a bigger impact on diversification and profitability than the entries.

The importance of not manipulating system entries/exits to force diversification, which can compromise consistency.

The benefits of trading as many markets as possible to ensure different entry/exit points and reduce correlation.

The key lesson of leaving your fate in the hands of the markets and not trying to interfere with big trends.

The importance of being willing to hold onto trends for as long as the system dictates, rather than getting out too early.

The preference for a mediocre, non-overoptimized system that is consistently followed over a more sophisticated approach that can break down.

Jerry's gratitude for the markets and how they have provided his lifestyle, emphasizing the importance of hanging onto long-term trends.

The common mistake traders make of getting out of trades too quickly, missing out on bigger trends.

Transcripts

okay welcome to trading tries the

Journey To Success With Jerry Parker

this is the third part in my three-part

series discussion with Jerry and now in

this talk in this part we're going to be

talking about over optimization and

Jerry's going to share a story of how he

used optimization and the unexpected

impacts it had on his trading results

we're going to talk about over

optimization how we can avoid it and

some solutions for Traders plus a whole

bunch of other stuff as well Jerry

doesn't hold back in this one so let's

get to

it

so now the third one I'd like to talk

about uh which you did uh mention a

little bit already you you were talking

about filtering um now something that I

think catches a lot of Traders out is

optimization or actually over

optimization so can you uh tell us about

some uh experiences you've had with

optimization and perhaps over

optimizing right yeah I have some sad

stories this is the sad part of the

podcast oh no um if I had a violin I'd

play but I don't know how to play either

but well even even so far I've told some

sad stories people are wondering does

this guy ever make any money how's he

been around for almost 40 years so

U uh yeah but I you know when we first

started trading

um the the first four years with Rich

were successful and then the next after

with Chesapeake you know 8 to 10 years

is uh we made money like every year and

that's one of the things about long-term

Trend following is that it has lots of

negative characteristics that we've

already talked about but it's very

reliable on an annual basis or you know

two-year basis it has a tendency to

really uh it may make it'll make money

but it may not be a lot of money but it

really um you have to sit with a lot of

draw downs and a lot of whipsaws but the

one thing it does give you is it's very

reliable and so we were just using these

simple approaches and having so much

success but it kind of like went to our

head a bit in the sense that well let's

do better you know making money every

year that's pretty darn good and our

clients loved it clients were very

greedy and they were throwing money at

us because we were so consistent but we

couldn't help oursel and we tried to do

research and it basically trying to

improve things we were listening to what

other Traders were doing profit

objectives take profit reduce your

positions based upon

volatility and then when we put those in

place we looked at the back test though

and we said this back test is pretty

amazing we're going to even be better

than we've been but then after about 3

or four months we saw performance that

we had never seen on the back test it

was so bad so we

immediately abandoned that that was

another good thing too that it doesn't

always happen with Traders I've seen

Traders get into the same situation and

be so committed to back testing and

research they're almost obsessed with

it that if they turn their back on their

latest research or the whole process of

doing research

then it's they really can't handle it

and we were basically came to the

opposite conclusion we were saying we

just went too far we can add more

markets we can become more Diversified

maybe we should be longer term there's

other things we can do in our research

process it doesn't violate the Ten

Commandments of trend following all the

great rules and philosophy we were I was

taught and

so I think that was a good move on on my

my part to sort of realize this

incredible mistake that I had made

because I literally was looking at just

months worth of data that um probably we

had lost money four months in a row and

our relative performance was pretty bad

and we had never seen something like

that in the back test so that's a very

good sign you know you you look at this

back test and right out of the gate you

know the performance is so bad and it

doesn't look anything like this

wonderful back test go back to the

drawing board and be willing to to

swallow your pride because it's all

about making money and doing what it

takes to make money and it's not about

scratching your itch to make sure to

make you think that how great you are as

a back tester or how smart you are I

like to think that I'm smart but I would

prefer to trade a methodology that's a

little less involved and less complex if

it's going to increase my ability to

make profit

yeah so what are your thoughts on

optimization now do you do you use it at

all or

not I don't use

um yeah I what we what I try to do with

my strategy is I want to like I said

trade as many markets as

possible stocks Commodities currencies

interest rates crypto crypto futures um

and then um have these Trend following

systems that are multiple systems like

maybe four or five different entries

four or five different exits so I think

this adds diversification as well so

literally what we would do is just focus

on um how how short-term can we trade we

don't want to be too

shortterm uh but what's a good

short-term paramet so we would test that

out uh once again just one entry one

exit and a stop loss

and then we would say okay how how

longterm can we

trade and then we would get a pretty

good indication of how that worked and

then we would literally just say okay

just trade a couple systems in between

without really even caring about

optimizing the parameters so much um

another way that we get away from

optimization is we don't pay very much

attention to the equity Equity curve in

the equity stats the draw downs and the

um the volatility and trying to smooth

out that Equity curve whenever you try

to smooth things out and increase your

sharp that's where it all begins that's

where the over optimization begins all

we paid attention to really was the

trade stats the average win the average

loss the average trade the win

percentage there's a hell of a lot of

stuff that happens in between the entry

and the exit right we just ignored it we

were like we don't care what happens in

between we just want to find systems

with healthy

um trade stats and that make the most

amount of money um per uh you know per

small loss so the the win loss ratio

here's what the here's what the average

win is here's what the average loss is

let's try to maximize

that and close our eyes and live with

draw Downs live with

volatility but it trade leverage wise in

a way that makes that possible of course

but I think uh and I've often said over

the years I try to take as little from

the back test as possible here's a good

place to buy there's a pretty good place

to sell we're done and um one of the

things that when you get into this trend

following uh the way we do it when you

get it you'll see that there is

this um group of parameters the shortest

to the longest where this all the

systems make about the same amount of

money and to me that's very

company

um so yeah I'm trying to give you lots

of examples in verbage but really I try

not to use

research very much or back testing very

much and and these are the reasons why

it's totally unnecessary we want our

systems

to and then we then we don't want to

stay too long and give back too much

profit that's kind of our job stay

within those parameters make it as

robust as possible with these few rules

and parameters as possible yeah yeah so

I like that approach of um having

multiple systems within the strategy I

guess that look over different uh time

Horizons like you mentioned shorter term

and longer term and then some in the

middle what about for people who maybe

don't have the capital requirements to

be able to do that and they've got to

just go I can just do one system here

how do you think they should approach it

yeah I think that's a little bit tougher

um I think

hopefully you can do at least two

systems a shorter term and a longer

term um yeah you know you have to maybe

yeah that that could be a little

difficult Capital requirements um for

sure but

um a good Trend following

system with um just one system if that's

all that you can do at the time it'll

help you over time get to a place where

you can do more you'll make money as

long as you have a good medium to

longterm strategy that doesn't try to

get in and and get out too quickly I

used to say we take small losses now I

think it's an optimal loss I think all

of these uh entries and exits and

parameters are kind of op optimal um

there's nothing magical there nothing

special really what makes them special

what makes them

work is the is is always doing them

that's the secret

is um always following your system

whether it's one system and maybe later

it'll be two or three or four but don't

do do whatever you can to put yourself

in a situation where you can do all of

the trades in the right way in the

systems way

um

and if you have to make this cutback the

great thing about the cutback too if you

have to trade small for a

while is

it allows you to keep doing the

trades whereas if you sort of like say

well like I'm really on the defensive

here I need to trade smaller I'll I'm

gonna have to choose some trades not to

do that's what you don't want to do you

want to do all the trades in the way

you're supposed to do them and this

cutback rule says oh all we did was just

reduce our leverage reduce our our

current positions and our future

positions for a while but we can go

right back to doing all the trades we're

supposed to do this is Magic this is uh

a

superpower uh being being

consistent

um our our systems are very similar and

they're very

correlated and from a Norm from a

traditional way of measuring correlation

people might ask why do you even bother

they they're all long you know you're

long orange juice or cocoa and you've

been long for a year or two and they've

all been long for a year or two and I'm

like yeah that's wonderful because

they're all making lots of money and so

the correlation measurement is kind of a

trick because it doesn't really matter

so much that in these

Trends um where it really matters your

exits are really going to have a big

impact um correlation is the wrong

measurement the when when you finally

get out of the sugar and the cocoa and

the Yen and some of these and Eli Lily

these exits that you have on your

systems will more than likely produce

vastly different

pnls some will get out near the high

some will give back more profit some

might get out too quickly and then the

market will will go back to the highs

and keep going and the longer term

systems will do better so it's really

for a trend follower looking at the

value of diversifying the exits in terms

of the profit in the trade you sort of

um no you don't know where the perfect

place to get out until after the trade

is done and then when you look at all

the data 4050 years worth of back

testing all the markets the conclusion

that the computer shows you is all these

systems make about the same amount of

money of course they do because you

can't

predict and they'll make the same amount

of money if you did all the trades that

you're supposed to in the way you're

supposed to yeah that's an interesting

Insight Jerry I think a lot of Traders

um when they look at correlation they're

really concerned with the entries and

they're not going to get in a a trade

because the you know they're already in

another trade and just from what you're

saying there that the exits are really

the ones that give you a lot of

diversification have you ever

compared uh entries and exits to see

which ones actually do um you know

provide better

diversification uh yeah for sure I think

the more you can spread them out the

better you know

um yeah so you've got to spread them out

a bit so that it makes you know more of

a

difference um yeah

but sometimes my entries are all the

same on a certain trade all my systems

get in on the same day and it's

definitely possible they can get out on

the same day they kind of these breakout

rules this is this is kind of a function

of using breakouts but um once again um

that brings up another idea of how

important it is to be Diversified so and

trade as many markets as possible if

you're getting in all at at the same

place in the crude maybe the entries in

the heating oil will be a bit different

and more spread out out uh it's very

important too to um not try to

manipulate the systems in the entries

and the exits to try to achieve

something else um like this

diversification or um spreading your

risk out you it just leads you to trying

to um not really follow the system as

much as you should um so I think I have

done that as well um

I want to space it out so I'll force

these systems to space out in some sort

of way that makes me feel better because

I don't like it when they all get in on

the same day you're screwing up with the

power of always doing the same thing

every time which is primo that's the

most important thing yeah y okay all

right well um so how do we summarize all

that Jer you we were just talking about

optimization and you shared so many

different uh uh inside here

so um how do we

summarize uh how do we summarize

that um don't do it I would say that we

we want we we're fine with minimizing

the

optimization right because we're going

to the benefit of not optimizing is more

robustness and more reliability with our

rules and the most important thing about

um you know if you have too many rules

multiple rules multiple parameters let's

all stick with one entry one exit and a

stop loss but multiple systems so the

50-day breakout the 75 day breakout the

100 day

breakout and then we'll have an exit um

in the same you know to get out with a

breakout but um yeah we don't want to

add in more and more filters more and

more uh conditions

uh loose pants let the markets go have

multiple systems that's rather than

overloading your one system with all

these different rules have multiple

systems with almost with very few rules

that's that's how you stay on the right

side of the robustness gods they will

punish you if you put too many rules in

there

yeah I like that yeah all right well uh

just as we finish up here Jerry you

mention mentioned that um we've been

talking all about sad stories uh up to

now do you have a happy story you'd like

to share or maybe some closing closing

comments to finish up for

today right I think my one of my big

lessons of treating all these years in

my style has been um you're you're

really leaving your fate in the hands of

the markets I almost think I don't want

to interfere don't get in the way

uh I promise you you know there's been

lean times and you just have to realize

that the markets will eventually bail

you out and have these big

trends and it is so much fun it's like

fighting a big

fish and Landing that big

fish um and they

will um when you have the opportunities

your job is to do the right thing with

the opportunities it's not to uh you

cannot produce these big trends the one

thing that you need to be successful is

totally out of your control the only

control you have is did I do what I

should have done with my possibly

mediocre system but a mediocre I'll take

a mediocre Trader a mediocre systematic

approach that's not over optimized in a

person who's dedicated and willing to do

all the trades and hang on to those

Trends and not be eager to get out too

quickly

uh over a more sophisticated approach

that can break uh much more easily so I

am so thankful for these markets that we

have and how they have bought all the

houses that I own and all my boats and

all my standard of living just because

uh I hung on to those long-term trends

whenever I talk to Traders that's the

one thing that they all tell me is I got

out too quickly I think um you want to

be that person who

try to stay as long as you can and you

only have to stay as long as your system

tells you to you can uh it's not like

you have to do something that's not

correct we only do it because the

computer tells us to do

it yeah well what a way to end our

discussion Jerry thank you very much for

that actually before we go I have to ask

you what's that picture behind you there

uh that what the

story that is um a Christmas gift from

my son

one of my sons gave me that it's my

picture instead of Leonardo Di

caprius play the turtle of Wall Street

right yeah yeah yeah yeah so um yeah

that's pretty funny right yeah I love it

yeah all right Jerry well uh thank you

very much for our discussion today for

anyone who wants to uh learn more from

you or get in touch with you how can

they do

that uh well first of all thanks for

having me it's been fun it went by

really quickly uh thanks for um giving

me this opportunity and ask me all these

good questions you really brought it

brought out the my juices were flowing

my memories were flowing um and but yeah

chesp capital.com and Twitter RJ Parker

jr9 uh Twitter and I'm on Twitter

spaces um we do a trend following spaces

every Friday 7

a.m. New York time and we we have some

Aussies on there so I know it's late yes

9 or 10 o'clock at night but I did uh I

did one of those spaces from uh from

Australia actually late at night so it

can be done and we have some good

friends on there so that's a good place

to learn about trading and uh to have

some camaraderie about trading November

was a tough month so it's good to have

people to uh we're going through the

same thing sometimes yeah yeah and you

post recordings of those on your Twitter

account as well because I listened to

one a few weeks back and it was great so

thank you for sharing that even though I

didn't make the the call it was really

nice to listen back to so I'll have

links to all that on underneath the

video here for anyone who didn't catch

it just then and go and uh check that

out so uh and also if you enjoyed my

chat with Jerry and everything that

Jerry shared with us today please give

us a thumbs up on the video and don't

forget to hit subscribe and the bell

button to be notified of any new content

all right Jerry well thank you again for

today it's been an honor speaking with

you and it did go by so fast it was

really enjoyable any closing

comments no no comments okay um we uh we

exhausted all I have um but thank you

for having me again it was wonderful I

enjoy hope to see you soon yeah likewise

take care take

care

5.0 / 5 (0 votes)

Искусственный Интеллект в Юриспруденции: Как нейросети применяют юристы

Алкашка очень жестокая

Алексей Романов. "Конфликт поколений"

Молодежь уходит из церкви! Разрыв поколений. Александр Шевченко

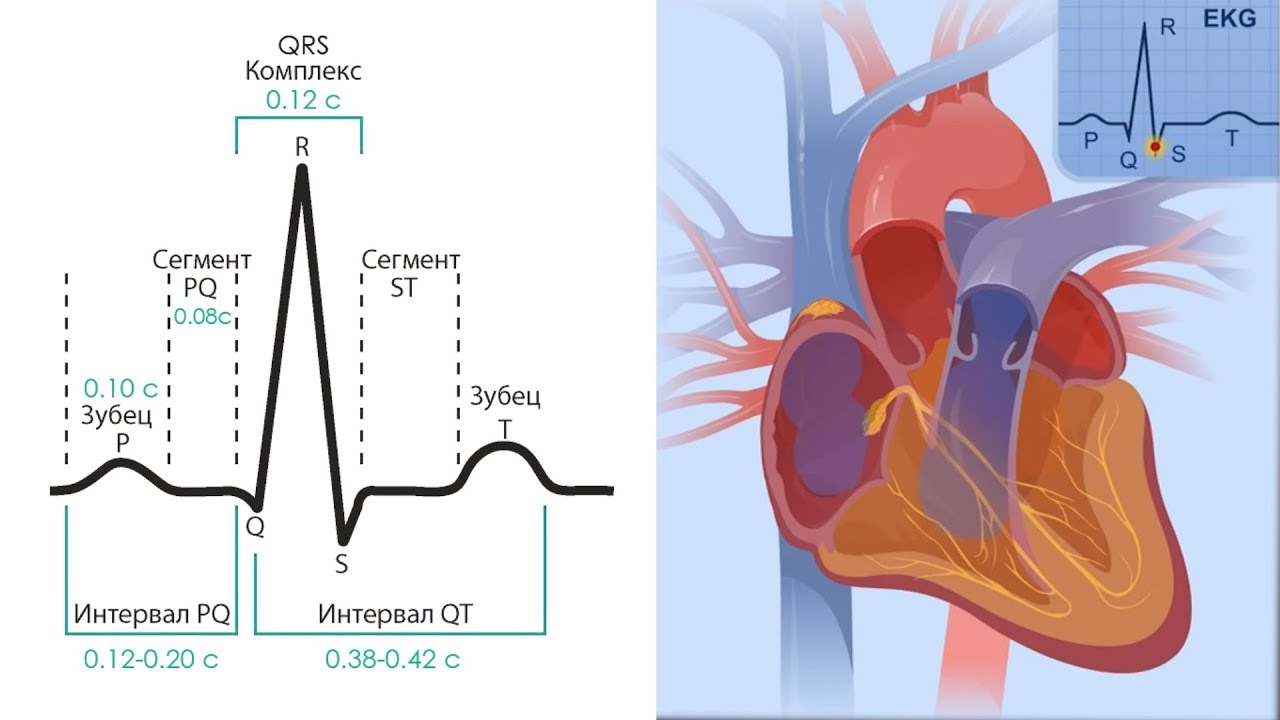

Основы ЭКГ за 100 минут | Проводящая Система Сердца | Зубцы, интервалы, сегменты на ЭКГ

Эта стратегия сделала меня финансово независимым! Smart Money