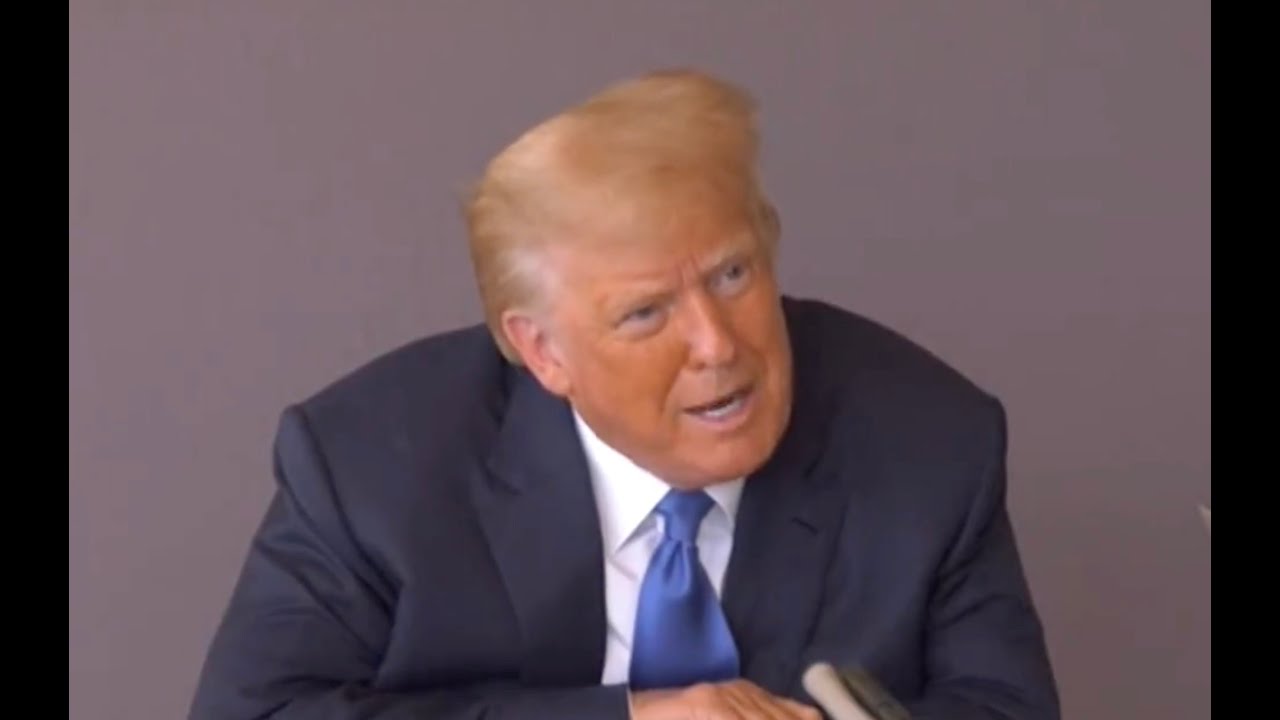

Breaking Down Trump’s Options to Pay $454M Civil-Fraud Penalty | WSJ

Summary

TLDR唐纳德·特朗普面临五亿美元的法律罚款,这一数字每天都在以数万美元的速度增长。纽约民事欺诈审判的判决代表了对这位前总统个人财富数十年来最大的考验。特朗普可能不得不变卖资产,这给特朗普组织带来巨大压力,存在资产开始崩溃的风险。目前,他有直到三月底的时间筹集资金,否则纽约州总检察长可能会开始没收他的部分资产。特朗普的律师表示,尽管与世界上一些最大的承租人进行了谈判,但他仍未能获得保证支付的债券。面对不断增加的账单,特朗普有哪些融资选项?据《华尔街日报》编辑彼得·格兰特分析,特朗普目前的净资产估计约为30亿美元。特朗普的现金储备受到质疑,因为法律问题不断增加。2月16日,纽约法官命令特朗普支付3.55亿美元的罚款,外加10亿美元的利息,利息每天大约增加10万美元。这是因为法官发现这位前总统欺诈性地评估了他的房地产帝国的部分资产,以获得更有利的贷款。特朗普上诉了这一裁决,但为了继续上诉,他必须为可能的全部罚款金额获得融资。特朗普的律师在3月18日向纽约上诉法院提交的文件中表示,他面临难以逾越的困难,认为以判决的全部金额获得债券是不切实际的。如果法院不干预,他们表示,特朗普可能被迫以低价紧急出售他的宝贵房地产。特朗普有三个不出售资产的方式来支付判决金:一是利用可用现金;二是以资产为抵押借款;三是从朋友那里借钱。最糟糕的情况是他开始出售资产,他将不得不迅速出售,买家可能会利用这种情况,他无法获得他希望的价格。尽管特朗普的一些财产被视为标志性财产,可能价值连城,但愿意花费这笔钱的人并不多。特朗普的律师在3月18日的法庭文件中表示,通过出售房地产获得现金将导致无法挽回的损失。特朗普在3月8日为另一起案件清除了一个财务障碍,当时他获得了近9200万美元的债券,以保证他欠作家E. Jean Carroll的诽谤判决。与此同时,特朗普的法律团队一直在专注于上诉工作。这些诉讼可能会持续一年或更长时间。如果特朗普在上诉中获胜,那么这一切就无关紧要了。除了法律费用外,他实际上不会损失任何东西。但要记住的另一点是,这些数字永远不会下降。它们会不断上升,直到上诉用尽。所以,假设唐纳德·特朗普在上诉中没有获胜,我们在最后看到的数字将会比现在看到的数字大得多。

Takeaways

- 📉 唐纳德·特朗普面临5亿美元的法律罚款,并且这个数字每天都在以数万美元的速度增长。

- ⏳ 特朗普有直到三月底的时间来筹集资金,否则纽约州总检察长可能会开始扣押他的一些资产。

- 💸 特朗普的律师表示,尽管与世界上一些最大的承租人进行了谈判,但他仍然无法获得保证支付的保证金。

- 🤔 据《华尔街日报》编辑彼得·格兰特分析,特朗普目前的净资产大约为30亿美元。

- 🔄 特朗普在1990年代初的经济衰退期间面临巨大压力,但他通过改变策略生存下来,并开始更多地利用自己的品牌。

- 🏦 特朗普近年来通过出售资产来增强资产负债表,目前拥有大约4亿美元的现金,并减少了约3亿美元的债务。

- 🚫 由于法律问题不断增加,特朗普的现金储备现在受到质疑。

- 💼 特朗普有三个支付判决的方法:使用现有现金、抵押资产借款和从朋友那里借钱。

- 🏛️ 如果法院不干预,特朗普可能被迫以低价快速出售他的房地产,这将导致无法挽回的损失。

- 📝 特朗普的律师在3月18日的法庭文件中表示,通过房地产的紧急出售获得现金将导致无法挽回的损失。

- ✅ 特朗普在3月8日为另一起案件清除了一个财务障碍,他为保证支付给作家E. Jean Carroll的诽谤判决获得了近9200万美元的保证金。

Q & A

唐纳德·特朗普目前面临多少法律罚款?

-唐纳德·特朗普目前面临高达五亿美元的法律罚款,并且这个数字每天都在以数万美元的速度增长。

特朗普的纽约民事欺诈审判结果对他的个人财富有何影响?

-特朗普的纽约民事欺诈审判结果是对他个人财富数十年来最大的考验之一。

特朗普可能需要采取什么措施来应对这笔巨额罚款?

-特朗普可能需要变现资产,并且这可能会给特朗普组织带来巨大压力,甚至可能引发连锁反应。

特朗普有多长时间来筹集罚款资金?

-特朗普目前有直到三月底的时间来筹集资金,否则纽约州总检察长可能会开始查封他的一些资产。

特朗普的律师在3月18日表示了什么?

-特朗普的律师在3月18日表示,尽管与世界上一些最大的承租人进行了谈判,但他仍然无法获得保证支付的保证金。

根据《华尔街日报》编辑彼得·格兰特的说法,特朗普目前的净资产是多少?

-根据《华尔街日报》编辑彼得·格兰特的说法,特朗普目前的净资产大约在30亿美元左右。

特朗普在1990年代初的经济衰退中面临了什么困难?

-在1990年代初的经济衰退中,特朗普无法支付他的债务,他的帝国开始崩溃,不得不出售许多资产,甚至不得不将他在大西洋城的一些赌场申请破产。

特朗普是如何应对1990年代初的经济衰退的?

-特朗普设法在经济衰退中幸存下来,并改变了他的策略,开始更多地利用他的名声和品牌,通过向开发商出售他的品牌来获得收益,而不需要承担风险。

特朗普目前的资产状况如何?

-特朗普目前在美国和世界各地拥有众多资产,包括度假村、公寓、酒店和大型办公楼的重要股份。他的资产负债表比过去更强,拥有大约4亿美元的现金,并减少了约3亿美元的杠杆。

特朗普面临的流动性问题是什么?

-特朗普面临的流动性问题是他需要支付高达3.55亿美元的罚款,加上另外1亿美元的利息,而且这个数字每天还在以大约10万美元的速度增长。

特朗普有哪些方式可以支付罚款而不出售资产?

-特朗普有三种方式可以支付罚款而不出售资产:一是通过可用现金;二是通过抵押资产借款;三是向朋友借钱。

如果特朗普无法支付罚款,他的律师表示会发生什么?

-如果特朗普无法支付罚款,他的律师表示,他可能被迫以低价紧急出售他的宝贵房地产,这将导致无法挽回的损失。

Outlines

💼 特朗普面临的财务困境

唐纳德·特朗普因纽约民事欺诈案面临着高达五亿美元的法律罚款,这笔金额还在每天以数万美元的速度增长。这一判决对他数十年来个人财富的最大考验之一。特朗普可能需要出售资产,并且这将对特朗普组织产生巨大压力,可能导致其财务状况雪崩。截至3月18日,特朗普的律师表示,尽管与世界上一些最大的包租方进行了谈判,但特朗普仍未能获得担保付款的债券。《华尔街日报》编辑彼得·格兰特分析了特朗普当前的财富状况,估计其净资产约为30亿美元。尽管特朗普目前面临巨大压力,但这与他在90年代初经历的经济衰退期间的压力不可同日而语。那时,特朗普因无法偿还债务而不得不出售许多资产,并将一些赌场置于破产状态。不过,特朗普通过改变策略,利用自己的品牌名声,减轻了自己的财务风险。如今,特朗普的资产组合更加坚固,现金约有4亿美元,且减轻了约3亿美元的负债。但他的法律问题使这些现金储备成为疑问,特朗普在2月16日被纽约一名法官判处支付3.55亿美元罚款及1亿美元利息,并且这将以每天约10万美元的速度增长。特朗普已对这一裁决提出上诉,但为了上诉能够进行,他必须确保能够获得足够的财务担保来覆盖可能的全额罚款。到目前为止,特朗普在筹集足够资金方面面临巨大挑战,且完全用现金支付罚款对他来说并不容易。

🏦 特朗普偿还巨额罚款的挑战

纽约总检察长的立场明确,若特朗普无法确保足够的担保来暂停诉讼进程,这将为她提供行动的机会。特朗普的律师承认,他缺乏足够的流动资金来支付判决金额。如果法院不介入,特朗普可能不得不以低价急售其珍贵的房地产。他有三种方式来支付这笔巨额罚款,而不必出售资产:使用现有现金、借用资产或向朋友借款。然而,最坏的情况是他不得不急售资产,这将迫使他以低于期望的价格快速出售,从而导致不利的情况。尽管特朗普的一些资产可能被视为标志性财产且价值巨大,但愿意花费大量资金购买这些资产的买家并不多。特朗普在3月8日为另一起案件克服了一项财务障碍,当时他获得了近9200万美元的债券,以保证支付给作家E. Jean Carroll的诽谤判决金。与此同时,特朗普的法律团队正在专注于上诉努力,这一过程可能持续一年或更长时间。如果特朗普在上诉中获胜,那么这一切的代价仅仅是债券成本和法律费用。但必须记住,这些金额将持续增加,直到上诉耗尽为止。假设特朗普上诉失败,最终的金额将远大于目前的数字,我们将回到目前的局面。

Mindmap

Keywords

💡法律处罚

💡资产清算

💡特朗普组织

💡流动性问题

💡债券

💡净资产

💡品牌授权

💡现金储备

💡破产

💡上诉

💡火售

Highlights

唐纳德·特朗普面临5亿美元的法律罚款,这个数字每天都在以数万美元的速度增长。

他在纽约的民事欺诈审判的判决代表了对这位前总统个人财富数十年来最大的考验之一。

特朗普可能需要清算资产,这将给特朗普组织带来巨大压力,存在一切开始崩溃的风险。

特朗普面临着时间的压力,目前他必须在三月底之前筹集到资金,否则纽约州总检察长可能会开始没收他的一些资产。

特朗普的律师表示,尽管与世界上一些最大的承租人进行了谈判,但他仍无法获得保证支付的债券。

根据《华尔街日报》编辑彼得·格兰特的分析,特朗普目前的净资产大约为30亿美元。

特朗普在1990年代初的经济衰退期间面临了巨大的压力,但他设法生存下来并改变了策略。

特朗普开始更多地利用他的品牌,通过向开发商出售他的品牌来获得收益,而不需要承担风险。

特朗普通过出售资产来加强他的资产负债表,他在美国拥有众多资产,包括度假村、公寓、酒店和大型办公楼的重要股份。

特朗普目前的资产负债表比过去更强,拥有大约4亿美元的现金,并减少了约3亿美元的杠杆,这使他在需要快速获得现金时有了更大的杠杆空间。

由于法律问题不断增加,特朗普的现金储备现在受到了质疑。

2023年2月16日,纽约法官命令特朗普支付3.55亿美元的罚款,以及另外1亿美元的利息,利息每天大约增加10万美元。

特朗普上诉了这一裁决,但为了继续上诉,他必须为可能的全额罚款获得融资。

特朗普的律师在3月18日向纽约上诉法院提交的文件中表示,特朗普面临着无法克服的困难,而且获得相当于判决全额的债券是不切实际的。

如果特朗普无法获得足够的担保来维持诉讼,纽约州总检察长表示将寻求法院的判决执行机制,并要求法官查封他的资产。

特朗普的律师承认他缺乏支付判决的流动性,如果法院不干预,他们表示特朗普可能被迫以低价抛售他的宝贵房地产。

特朗普有三种支付判决的方法而不出售资产:一是通过可用现金,二是通过抵押资产借款,三是通过向朋友借钱。

最坏的情况是特朗普开始出售资产,他不得不迅速出售,买家可能会利用这种情况,他无法获得他希望的价格。

尽管特朗普的一些房产可能被视为标志性房产,价值连城,但愿意花费那种金额的人并不多。

特朗普的律师在3月18日的法庭文件中表示,通过出售房地产获得现金将导致无法挽回的损失。

特朗普在3月8日为另一起案件清除了一个财务障碍,当时他获得了近9200万美元的债券,以保证他欠作家E. Jean Carroll的诽谤判决。

特朗普的法律团队一直在专注于上诉工作,这些诉讼可能会持续一年或更长时间。

如果特朗普在上诉中获胜,那么除了法律费用外,目前的所有问题都将不复存在。

需要记住的是,这些数字永远不会下降,它们会不断上升,直到上诉耗尽。

Transcripts

- [Narrator] Donald Trump

is facing half a billion dollars in legal penalties,

an amount that's growing by tens

of thousands every day.

The judgment in his New York civil-fraud trial represents

one of the biggest tests

of the former President's personal wealth in decades.

- He is probably gonna have to liquidate assets,

and I think it is gonna put tremendous pressure

on the Trump organization,

and there's a risk that it all begins

to cascade.

- [Narrator] And he's up against the clock.

For now, he has until late March to come up with the funds.

Otherwise, the New York Attorney General could begin

to seize some of his assets.

On March 18th,

Trump's lawyer said he has been unable to obtain a bond

to guarantee payment despite negotiating with some

of the largest charterers in the world.

So what options does Trump have

to finance this mounting bill?

We asked Wall Street Journal editor Peter Grant

to break down where

the former President's wealth stands today.

- We've looked at his business for a long time

and our best guess is that his net worth today

is roughly around $3 billion.

Trump is under a lot of stress right now,

but it doesn't compare with the kind of stress

that he's facing during the recession of the early '90s.

- In 1975, we had a recession,

but that was a picnic compared to this.

That was an absolute picnic.

- Just before that recession,

he was a lot more ambitious in terms of his business goals

and he was buying assets right and left.

- We got it out on time for you folks.

So we're gonna really be a good competitor

and I think it's gonna be a lot of fun.

- When the recession of the early 1990s hit,

he couldn't pay his debts and his empire began to crumble.

He had to sell a lot of these assets,

but even more he had to put some

of his casinos in Atlantic City into bankruptcy.

He himself was on the brink of personal bankruptcy.

- [Narrator] Trump managed to survive the recession,

and then changed his tactics.

- He started to leverage more his name, his brand.

He would sell his brand to developers

who would be building projects.

They put the Trump name on it,

but Trump wouldn't have the risk.

One of the things that Trump has done

to shore up his balance sheet in recent years

is sell assets.

Trump has numerous assets throughout the world.

They're primarily in the US, the ones he owns.

He owns resorts, condos, hotels,

and he has pretty big stakes in some big office buildings.

The Trump balance sheet today

is much stronger than it used to be.

It has roughly $400 million of cash on it,

and he's deleveraged by about $300 million,

which puts him in the position

of increasing leverage if he needs fast cash.

- Those cash reserves are now in question

as his legal troubles mount.

On February 16th,

a New York judge ordered Trump

to pay $355 million in penalties,

plus another $100 million in interest, which will continue

to grow by roughly $100,000 per day.

This comes after the judge found the former President

fraudulently valued parts of his real estate empire

to secure more favorable loans.

- The cases a complete and total sham. It's a sham case.

- There's a liquidity problem fundamental to all of this.

The likelihood that somebody

has $450 million sitting around just is not possible.

- [Narrator] Trump appealed the ruling,

but for it to move forward, he must secure the financing

for what might be the full amount of his penalty.

In late February,

an appeals judge rejected an offer from Trump's lawyers

to post a $100 million bond, rather than the full amount.

That decision is under review by a panel

of appellate judges.

Trump doesn't have too many options.

He could put up the entire amount in cash,

but doing that isn't easy.

- He can't deplete all his cash.

He needs a significant amount of cash to pay the bills,

so he can't use all $400 million.

- [Narrator] On the other hand, Trump could secure a bond

that would guarantee payment if he were to lose his appeal.

They're typically backed by cash, investments,

or other assets.

- He could potentially borrow against those assets,

come up with the cash, and just use that cash for the bond.

- [Narrator] The fees a company might charge

for the bond could also prove costly.

- It's like any other instance in which you're securing

a line of credit of sorts, right, which is,

there's gonna be a negotiation

over what they're gonna charge you for this.

So I don't think anybody thinks this

is gonna be an inexpensive bond.

- [Narrator] Trump has until late March to post a bond.

But in a filing to a New York Appeals Court on March 18th,

his lawyer said he has faced insurmountable difficulties,

and that a bond in a judgment's full amount

is a practical impossibility.

- We will seek judgment enforcement mechanisms in court,

and we will ask the judge to seize his assets.

- The AG has no interest in keeping it quiet.

I think there is no question that if Trump is unable

to secure the kind of undertaking that will allow him

to stay the proceeding, this is game on for her.

- [Narrator] Trump's lawyers have acknowledged

he lacks the liquidity

to cover the judgment.

If the court doesn't intervene, they said

that he might be forced to unload

his prized real estate in a fire sale.

- He has three ways

to pay off the judgment without selling assets.

One would be through the available cash.

Two would be borrowing against the assets,

and three would be borrowing money from friends.

The worst case scenario would be for him

to start selling assets.

He'd have to sell them quickly.

Buyers would have the potential

of taking advantage of the situation,

and he wouldn't get the kind of prices

that he would hope for.

So that would be a certainly a bad scenario for him.

- Even though some of these properties may be viewed

as iconic properties, they may be worth a lot of money,

there aren't a lot of people who are willing

to spend that kind of money.

- [Narrator] A spokesperson for Trump

did not respond to questions

over how he plans to finance the judgment.

His lawyer said in the March 18th court filing

that obtaining cash through a fire sale

of his real estate would result in irrecoverable losses.

Trump cleared one financial hurdle

for a separate case on March 8th when he secured

a nearly $92 million bond to guarantee

a defamation judgment he owes

to writer E. Jean Carroll.

In the meantime, Trump's legal team

has been focused on its appeal efforts.

It's possible those proceedings could last a year or more.

- Worry he'd win the appeal.

And in this instance,

let's assume win means the entire conviction is vacated,

then none of this matters.

The only thing he would actually be out at this point

other than legal fees, would be the cost of the bond.

The other piece that you always have

to remember is these numbers aren't ever going down.

They're going up and up and up,

and they will continue to go up

until the appeal is exhausted.

So, assuming Donald Trump does not win on appeal,

the number that we're gonna see at the end

of this is gonna be significantly larger

than the number we see now.

And again, we're gonna be right back here

where we are today.

5.0 / 5 (0 votes)

IT'S OVER: Trump Properties Can Be SEIZED As Court Rejects Bond | The Kyle Kulinski Show

Trump Claims He Has '$500 Million' Cash For His Bond #TYT

Trump hit with SURPRISE, unexpected court loss

Trump hit with SURPRISE bad news in NY trial

‘The Five’ reacts to Trump’s New York court victory

ABC World News Tonight with David Muir Full Broadcast - May 7, 2024